During the week, international oil prices reached a new low, and the negative momentum of polyester costs increased sharply. In addition, the situation of foreign public health incidents intensified, and the reduction and cancellation of terminal export orders gradually appeared. The mentality of the recycled PET market was disturbed, and the quotations of cleaning plants Subsequently, it was lowered, but the supply of old materials was tight, and the recycled PET market was in a dilemma.

Figure 1 Brent crude oil futures price trend chart from 2018 to 2020

As shown in Figure 1, international oil prices fell sharply this week. The lockdown of many overseas countries led to a sharp drop in oil demand. At the same time, Saudi Arabia and Russia planned A substantial increase in production and increased concerns about oversupply are the main negative factors. As of the close on March 18, 2020, WTI ranged from 31.73 to 20.37 US dollars per barrel, and Brent ranged from 33.85 to 24.88 US dollars per barrel.

Faced with the sharp drop in international oil prices, it is self-evident that the domestic recycled PET market is worried.

1. Polyester double raw materials are diving, and new material slices are about to “break 5”.

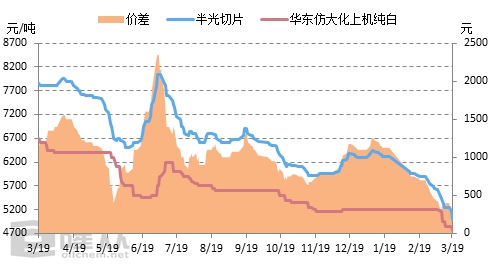

Figure 2 Comparison of semi-gloss slicing and recycled PET trends from 2019 to 2020

Current PTA , ethylene glycol futures weakly fell to the limit, the polyester chip market was relatively chaotic, market transactions were in a wait-and-see mentality, and the willingness to “buy the bottom” further declined. At present, the mainstream price of semi-glossy slicing in Jiangsu and Zhejiang is around 5,000 yuan/ton, and the reference price for glossy slicing is 5,050 yuan/ton. “Breaking 5 is imminent.” In the short term, some operators see optical slicing prices reaching 4,800 yuan/ton. The price difference between new polyester semi-gloss chips and recycled PET imitation Dahua machine white chips has narrowed to a new low of around 200 yuan in recent years.

2. The domestic supply of old materials has been interrupted, and it will take some time to recover

According to the editor’s understanding, due to the relatively early recovery time of cleaning plants in Jiangsu, Zhejiang and Guangdong, local and surrounding packaging stations have basically digested the bottle brick stockings from the previous year, and the overall supply of packaging stations is only one-third of the same period in previous years. , some cleaning plants said that their purchasing volume this week has decreased compared with last week, ranging from 50-60 tons per day, or 200-300 tons per day. Cleaning plants in Hebei and Shandong have resumed work relatively late. Some cleaning plants have resumed work this week, or plan to resume work at the end of the month. Year-old supplies from packaging stations around Beijing and Hebei will begin to be released this week.

However, due to the impact of domestic public health events, domestic soft drink consumption dropped sharply in the first quarter of 2020. The supply of new batches of raw bottles and bottle bricks is very few, and it is expected to recover. The buffer period is around 15-20 days. At present, the domestic purchase price of raw bottles is around 2,900-3,000 yuan/ton, and the quoted price of variegated bricks is 3,500-3,600 yuan/ton. Weekly and monthly settlements add 100 yuan/ton. The procurement competition for high-quality white bricks is fierce, and cleaning plants quote prices ranging from 4,400 to 4,900 yuan/ton.

3. Domestic demand has not yet recovered, and export shrinkage is coming

Domestic demand , the most direct impact of the public health incident is the shrinking of consumption. This year, the terminal clothing industry is facing the disappearance of the peak season and entering the off-season. According to the traditional market situation, before the Qingming Festival is the peak season for domestic garment factories to receive orders, after the Qingming Festival it gradually enters the off-season. This year’s golden period for spring clothing consumption has passed. After the epidemic is lifted, actual consumption will still take time to recover. The increase in spring clothing inventory indirectly affects the production and circulation of autumn clothing.

In terms of external demand, as overseas public health incidents heat up, summer and autumn clothing and toy orders from Europe, the United States, Japan and South Korea have shrunk and canceled orders to varying degrees. In previous years, with the help of foreign trade In terms of orders, domestic weaving factories cannot arrange domestic trade orders at all, but the current situation is exactly the opposite. Foreign trade orders cannot support their full-capacity production.

The sluggish demand has been transmitted to the recycled chemical fiber level. Although the industry operating rate is only 16%, the inventory continues to rise to around 13-15 days.

Figure 3 Domestic recycled fiber inventory trend chart in 2020

To sum up, the current negative environment at home and abroad is shrouding the market, and the trading mentality of merchants in the industry continues to cool down. Some chemical fiber factories that have no orders have taken advantage of this situation to quote low-end purchase prices. However, Due to cost pressure, it is difficult for cleaning plants to complete actual orders. The prices on the market are slightly chaotic. Most cleaning plants negotiate on a case-by-case basis for shipments.

But as the saying goes, crisis, danger and opportunity always go hand in hand. According to the editor, some cleaning plants have received orders from recycled polyester chip manufacturers and differentiated spinning filament manufacturers. According to the purchase order of bottle flakes, some cleaning factories plan to properly “cut” the inventory of bottle flakes from the year before, and use the funds to prepare for the bottom-up operation of bottle flakes to revitalize the market.

At present, the overseas epidemic situation is unlikely to improve significantly in the short term. If there is still no news that OPEC will return to production reduction negotiations, it is expected that international oil prices will remain low next week and may continue to decline. possibility. It is expected that WTI may operate in the range of 18-23 US dollars/barrel, and Brent may operate in the range of 20-26 US dollars/barrel. As the general environment is still unclear, it is recommended that everyone stabilize their confidence, preserve their strength, and wait for opportunities. </p