There is a backlog of cotton reserves, but the price of cotton has skyrocketed. Who is driving the skyrocketing price of cotton?

July 20 , there was a heavy rain in Beijing, and almost all flights from Hubei to Beijing were cancelled. Sun Ying’an, chairman and general manager of Hubei Xiaomian Industrial Group Company, took the high-speed train instead and rushed to Beijing. Joining him in the rain were the CEOs of more than 150 textile companies across the country who went to Beijing to attend a symposium on cotton textile companies.

“The price of cotton has really gone crazy. If we don’t find a way, we really can’t survive.” This became the opening remarks of the bosses.

On the one hand, there is a backlog of national treasury reserves, but on the other hand, cotton prices are skyrocketing, and textile companies have no cotton to spin. What went wrong?

“Cotton Palm” hit the fabric industry hard

The state reserve cotton has been launched for 3 months, and the price has increased by as much as 30%. The psychological price of enterprises has been repeatedly criticized. Breakthrough

At the beginning of this spring, the news that cotton reserves will be put on the market in April spread among textile companies. Manipulating cotton stocks to reduce costs has become a unanimous decision among companies. However, what caught the company off guard was that the announcement of the release of reserve cotton was not announced until April 15, and the release date was also changed to May.

“We started manipulating cotton stocks in March, but we didn’t expect that the state would not release cotton at all in April. In order to keep orders, we had to go to the market to buy high-priced cotton.” Sun Ying’an said.

The release of cotton reserves was delayed, making cotton suddenly a hot commodity, and cotton prices began to soar. Taking Xinjiang cotton companies as an example, in March and April, the inversion between the cost and selling price of cotton companies in Xinjiang expanded from 200 yuan to 300 yuan/ton to 1,200 yuan to 1,500 yuan/ton, causing companies to panic.

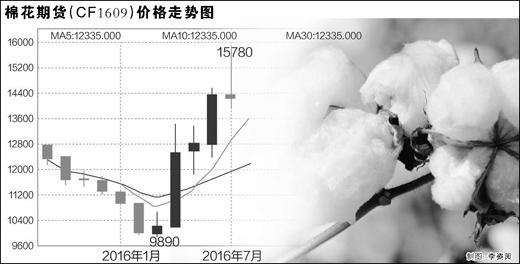

Fabric companies that thought they would get a break after a month soon discovered that after the reserve cotton was released, cotton prices not only failed to calm down, but became even more crazy. Since the sale of reserves on May 3, the transaction rate of state reserve cotton has exceeded 98%, and the price has also surged from 12,428 yuan/ton to the high transaction price of 16,350 yuan/ton on July 28, an increase of more than 30%. The high price of state-owned cotton has led to the continuous rise of spot lint cotton. The quotation of lint cotton has also increased from about 11,000 yuan/ton in early April to about 15,000 yuan/ton, with a cumulative increase of about 35%.

“In February and March, the factory price of our cotton purchase was 12,300 yuan/ton. We also communicated with others and said, ‘It is going to be stored and no more shipments will be made.’ As a result, The storage was delayed, and later the price of state-owned cotton began to skyrocket.” Wu Mingfeng, general manager of Vosges Group Co., Ltd., revealed that the company’s meeting frequency for cotton procurement was shortened from every 10 days to every 3 days. “During the meeting, what everyone said most was ‘crazy again’. The price has soared that we can’t even start.”

Di Hui, deputy general manager of China Resources Fabrics Group, also said frankly that because of the national To release the stock for auction, the company deliberately controlled the inventory and the rhythm of buying cotton in the early stage. Unexpectedly, it could only buy high-priced cotton now. “The orders for export companies were all signed at the end of last year, and the order prices will not change. However, the cotton price cannot catch up even if it is pursued, and the psychological price has been exceeded again and again.”

What makes enterprises even more unexpected is that cotton is not only expensive, but also “hard to find”. “Originally, our purchase intention was for more than 11,300 tons, but now we have only sold more than 3,700 tons, with a transaction rate of less than 32.8%.” Di Hui lamented.

Lu Xiping, deputy general manager of Henan Xinye Fabric Company, also said that the company’s current cotton consumption is very tight. “Since June, the company’s cotton inventory has been at a particularly low state, but the reserve cotton has only been released in more than 20,000 tons per day. Enterprises cannot buy more if they want to, and there are almost no spot resources on the market. In order to ensure that there is enough cotton, The company has spent all its efforts to use it.”

The relevant person in charge of Huafu Colored Spinning also said that before, the company would not buy cotton with a micronaire value lower than C1 grade. Now, The company only expected to buy cotton.

Behind the “crazy” price of cotton reserves

Human factors such as low reserves, traders’ “cut-offs”, and delays in managed warehouses Leading to “difficulty in using cotton”

“If you don’t buy it, you will stop production, if you buy it you will go bankrupt.” This is the summary of many textile companies on this round of state-owned cotton bidding. However, what puzzles companies is the reason for this round of soaring prices of state-owned cotton.

Is cotton supply tight? Domestic cotton supply is quite sufficient.

“The embarrassment now is that there are a lot of cotton reserves, but fabric companies have no cotton available.” Wang Qiang, executive president of Shandong Ruyi Group, said, “There are more than 10 million tons of cotton reserves piled in the warehouse. Last year we had another bumper harvest, and we had nearly 20 million tons of cotton supply. It’s really strange that companies are forced to suspend production when the cotton supply is so large!”

Is it an outbreak of market demand? ? External demand is sluggish, domestic demand is stable, and there is no sign of a demand blowout.

“Companies think this surge in cotton prices is strange.��Regulatory rules have been introduced and there will be corresponding penalties for warehouses that cannot deliver cotton on time. Companies generally report that currently there are fines for companies that cannot pick up goods within 10 days, but there is no corresponding compensation for failure to deliver goods from the reserve within 10 days. Rights and obligations are corresponding, and the efficiency of raising funds should be borne by both parties.

Restricting the auction and storage of non-cotton companies for a period of time is also a suggestion of many companies. “The order was signed in the fourth quarter of last year. We cannot default. And there are more than 100 small businesses working with us. If we stop working, what will happen to these small businesses? Can the country ban or restrict non-cotton products for a period of time? Companies auction and reserve, thereby squeezing the space for speculation and protecting cotton used by the real economy?” Wu Mingfeng suggested.

To fundamentally solve the “cotton disaster” faced by the fabric industry in recent years, we still need to rely on deepening reforms. Recently, the National Development and Reform Commission and the Ministry of Finance jointly issued a document, extending the time for selling stocks from the end of August to the end of September, and the total amount can exceed 2 million tons. Futures prices and auction transactions have subsequently dropped, and companies have entered a new round of wait-and-see and market panic.

“The current rise in cotton prices is essentially a conflict between the planned economy model and the market economy model,” Sun Ruizhe, vice president of the China Fabric Industry Federation, suggested that the country raises the The daily amount of cotton put in, the cotton selling system is tilted towards production-oriented enterprises, and storage should not be stopped before new cotton is launched. In addition, in response to the gap in high-quality cotton, import quotas should be increased. “At present, the fabric workwear industry accounts for about 13% of my country’s export trade and about 12% in terms of employment. Its importance is obvious. Only by continuing to play the decision-making role of the market in resource allocation and reducing institutional transaction costs can we further consolidate The international competitiveness of the fabric industry.”

AAASDFERHYTJTI

Disclaimer:

Disclaimer: Some of the texts, pictures, audios, and videos of some articles published on this site are from the Internet and do not represent the views of this site. The copyrights belong to the original authors. If you find that the information reproduced on this website infringes upon your rights, please contact us and we will change or delete it as soon as possible.

AA