During the Spring Festival, China’s polyester filament market is closed, and market transactions are light. However, due to the extension of the Spring Festival holiday, uncertainties in downstream resumption of work, and the accumulation of inventory in some factories with high loads during the Spring Festival, companies With more negative cuts and risk aversion, on-site construction started to decline further.

The domestic polyester filament market supply and demand are both weak during the holidays. Most downstream texturing, weaving, and printing and dyeing companies stopped for holidays in mid-January, and most users had concentrated on replenishing their positions at the end of December and early January. Market demand entered a freezing period, and few transactions were heard.

Domestic production companies are cautious in their market outlook. During the Spring Festival, they tended to reduce their load and avoid risks, and the industry’s operating capacity dropped to around 70%. However, after the holiday, affected by force majeure events, it took longer for workers to return to work. Postponed, the polyester filament market continues to be in a situation of weak supply and demand. Most companies have not yet made clear quotations, and a small number of companies have maintained pre-holiday price levels. Due to the lack of effective transaction information, there is no market price guidance.

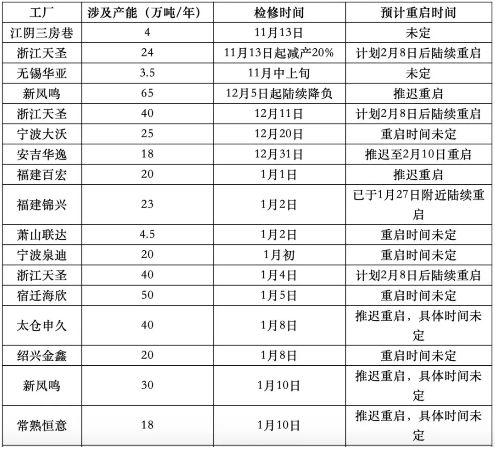

Statistical table on the operation of domestic polyester filament installations before and after the Spring Festival

According to statistics: As of press time, before and after the Spring Festival holiday, the domestic melt direct spinning polyester filament maintenance capacity involves 10.802 million tons/year, Among them, Tongxiang No. 1 Factory, Xinxin, Tiansheng, Southeast, Kaishi, Zhenhui and other companies have added maintenance devices. In February, some companies still expanded their maintenance efforts. Due to this special period, some factories that had previously planned to restart at the end of January and early February have now postponed their restart plans. The delay time is around 1-2 weeks, and the basic plan is to gradually restart after February 9, depending on the situation.

Affected by the Lunar New Year, the start-up rate of chemical fiber weaving in Jiangsu and Zhejiang has gradually declined. Weaving companies in various regions have suspended work and have holidays on a large scale, and a few large companies have reduced production during the Spring Festival. Before the holiday, most companies planned to start operations from the eighth to the fifteenth day of the first lunar month, and some planned to resume operations from the fifteenth to the twentieth of the first lunar month later. However, due to the escalation of force majeure events, weaving companies in various regions have not resumed operations yet.

Currently, some companies plan to start construction as early as February 10 (the seventeenth day of the first lunar month), while in some areas the start time is later or postponed to February 17 (the twenty-fourth day of the first lunar month). , the actual resumption of production still needs to be adjusted based on the arrival of non-local employees. It is expected that the operating rate of looms in various regions will gradually return to normal levels by the end of February.

Main raw material PTA: Affected by the Spring Festival holiday, downstream terminal loom workers have returned home one after another, and many downstream texturing and weaving companies have stopped for holidays. Demand has entered a freezing period, and polyester companies have also Holiday mode has been started one after another, and businesses have gradually left the market. As of January 23, the price of PTA closed at 4,740 yuan/ton.

After the Spring Festival, the PTA market is hardly optimistic. Considering that the current economic and demand prospects are not optimistic, the first half of the year may still be subject to bearish demand expectations, resulting in weak cost support for PTA, and the mentality is not optimistic; while PTA’s own equipment is operating stably, supply is high, and at the same time affected by Affected by the Wuhan incident, the inventory of polyester companies is high, maintenance companies often delay start-up time, and terminal companies delay their return to the market by 2-9 days. Under the dual pressure of high market supply and sluggish demand, PTA’s accumulated inventory pressure is expected to increase again. It cannot be ruled out that PTA will be affected by high inventory and the company will stop operating. In the later period, the PTA market will be difficult to get rid of the weak situation, and the price may fluctuate around 4200-4400 yuan/ton.

Affected by force majeure events, domestic polyester filament yarn plant restart plans have been postponed one after another. During the Spring Festival, there were few domestic transactions, and corporate inventory pressure was high. In addition, market outlook is cautious and pessimistic. As more strategies are adopted to reduce burdens and avoid risks, the start-up of polyester filament yarns in February is still on a downward trend, and the start-up is expected to drop to around 65%.

On the downstream side, the start of the weaving, printing and dyeing industries in Xiaoshao and other regions has been postponed to around mid-February. In the early stage, the inventory is mainly digested, and it is difficult to produce and sell polyester filament in the short term. Therefore, domestic polyester filament yarns will continue to have a weak supply and demand situation in February.

</p