New York oil prices plummeted on the 20th. The price of New York light crude oil futures for delivery in May plummeted about 300%, closing at -$37.63 per barrel. . Meanwhile, Brent crude, the international benchmark June contract, fell 8.8% to trade at $25.60 a barrel. The June WTI contract expiring on May 19 fell about 15.7% to trade at $21.10 a barrel. The July contract was down about 5% at $28 a barrel. Crude oil futures fell to negative, which is really a “long-lasting”.

Under the influence of the sharp drop in crude oil, the prices of polyester products also fell.

PTA, as of the close of trading at 15:00 on April 21, The PTA futures 2009 contract closed at 3314 points, down 90 points or 2.64% from the previous trading day.

As for ethylene glycol, as of the close at 15:00 on April 21, the ethylene glycol futures 2009 contract once fell to the intraday limit, and the final closing price was 3512 points, down 171 points from the previous trading day. , a decrease of 4.64%.

In terms of polyester filament, the polyester yarn of a major mainstream manufacturer in Shengze, Jiangsu fell by 50% -100 yuan/ton, polyester yarn from a major major factory in Tongxiang fell by 100 yuan/ton, FDY from a factory in Shaoxing fell by 100-200 yuan/ton, and all major major manufacturers fell by 100-200 yuan/ton.

High inventory + low demand, selling oil actually costs money

On Friday, U.S. May crude oil prices were about to expire Futures contracts have fallen to the lowest settlement price since early 2002, and U.S. crude oil inventories have also “broken through the sky.” Domestic inventories have increased to 508 million barrels, an increase of 18 million barrels in a week. In addition, offshore inventories cannot be underestimated, because oil prices Due to the downturn, traders have stepped up their reserves of crude oil. Currently, they have about 160 million barrels of oil stored on tankers, more than double the amount of reserves two weeks ago.

In addition to inventories, as the epidemic spreads, crude oil has also been hit on the demand side. The United States is at the “epicenter” of the world’s epidemic: According to the real-time epidemic monitoring system of Johns Hopkins University in the United States, as of 6 p.m. Eastern Time on April 20, there have been at least 782,159 cases of new coronavirus infection in the United States, including deaths. There are 41,816 cases.

Affected by this, the latest monthly report released by OPEC predicts that crude oil demand will decrease by 6.9 million barrels per day this year, and that in the second quarter it will decrease by 12 million barrels per day compared with the same period last year. Judging from the demand for crude oil, it has dropped sharply to 20 million barrels. Global demand for OPEC oil production is expected to average less than 20 million barrels per day in the current quarter, the lowest since early 1989.

Crude oil suffers from high inventories and low demand Under the double blow, how to remove inventory has become the most troublesome problem for sellers. On April 18, in Texas, the United States, crude oil buyers quoted an ultra-low price of US$2/barrel during bidding, which was a huge difference from the price a month ago. This staggering crude oil price has made Texas crude oil producers begin to worry, and they may have to sell crude oil later. Such worries soon became reality. On April 20, Canadian crude oil had reached zero. For every barrel of crude oil bought by the buyer, the seller had to pay US$0.01.

Seeing this, the editor couldn’t help but sigh, Why is this plot so familiar? The polyester and textile markets seem to be the same.

In terms of polyester inventory, according to the statistics of China Silk Capital Network, the overall inventory of the polyester market is now concentrated at 27-37 days; in terms of specific products, POY inventory is at 21-21 days On 27 days, FDY inventory is around 22-28 days, while DTY inventory is around 27-37 days.

In terms of production and sales, from the wave of market conditions in early April Since then, weaving companies have maintained a wait-and-see attitude, and polyester yarn production and sales have been hovering around 30% to 40%.

The same is true for the weaving end. Under the influence of the epidemic, even though weaving companies have begun to gradually reduce production, they still face the double blow of high inventory and low demand.

In terms of inventory, according to data monitoring from China Silk City Network, as of April 17, the average inventory of weaving companies in Jiangsu and Zhejiang has been as high as 42.5 days, almost the same as last year’s highest point.

On the demand side, according to visits to the market in the past two weeks, it was found that the number of new orders in the textile market has dropped sharply this year, except for some years ago. Old customers have already negotiated rigid orders, and weaving companies have almost no more goods. Traders also lack confidence in the subsequent market. Even if the price is now very low, they still do not have the courage to buy the bottom.

In terms of operating rate, due to high inventories and severe suppression of demand, a large number of weaving companies have reluctantly chosen to reduce operating rates, and the operating rate of looms has dropped to about 67%.

The editor has previously done a survey on the start-up rate and production suspension of weaving companies. More than 300 companies participated in the survey. The survey shows that a quarter of the companies have a loom operating rate between 50% and 74%, and more than 40% of the companies have a loom operating rate of less than half.

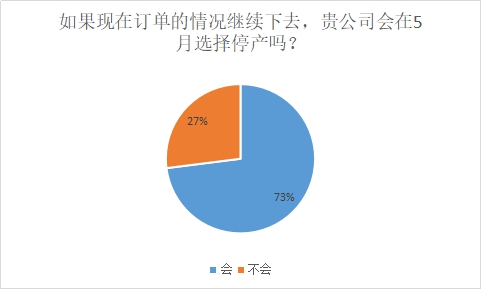

If the current lack of orders continues until May, 73% of weaving companies Will choose to continue shutting down machines, and further shutdown measures for weaving companies are just around the corner.

Postscript

Whether it is the polyester end or the woven end, it is a similar script to crude oil. For textile people, this scene of negative oil prices has extraordinary awakening significance: on the one hand, crude oil is the most source of raw materials for polyester products, and its rise and fall will eventually be transmitted to the weaving end; on the other hand, the decline in crude oil Mainly due to reduced demand and excessive inventory, weaving companies are also facing the same problems at this stage, and textile people need to take warning from this.

</p