The Double Eleven carnival has come to an end, and major e-commerce companies have launched subsidies, price cuts, red envelopes, tax exemptions and other activities to stimulate consumers to “buy, buy, buy.”

This seems to be an effort to pull up the previously lost turnover and reduce the previous backlog. A large amount of inventory is released and passed on to consumers. But after the carnival is over, the editor has to pour some “cold water” on it. Can this method of cutting leeks and clearing inventory really save the entire industry chain from “overcapacity”?

Inventory is difficult to reduce, replenishment orders are limited, and the day is not as expected

Despite the overwhelming online Double Ten For various sales data, let’s first look at some data on the weaving market during Double Eleven this week:

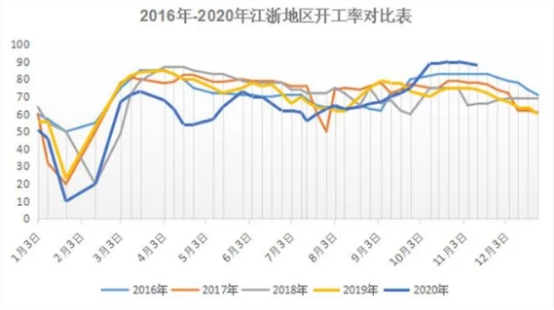

In terms of operating rate, the market transactions have become differentiated recently. The transaction of woven products is not as good as in the previous period, especially the hot-selling autumn and winter clothing fabrics in the early period. After a wave of shipments, the demand has decreased significantly, and the operating rate of water-jet looms has remained at 8 -90%, some manufacturers have declined, warp knitting machine orders are still good, and the operating rate is above 90%. The overall operating rate in Jiangsu and Zhejiang remains at a high level of less than 90%, but there is a downward trend.

In terms of inventory, the weaving market ushered in a peak season in October, and the market was obviously It dropped from the previous high of 45 days to about 40 days. Many manufacturers of marketable products have successfully transferred their inventory during this wave of market conditions, and market confidence has been restored.

However, in November, as the Double Eleven stocking comes to an end, there are not many re-orders and replenishment orders in the market, and the market goods are obviously sluggish. Under high-load operations, Market production and sales are once again difficult to level off, and inventory has increased slightly. Many manufacturers have clearly felt that inventory has begun to accumulate again this week, and there is greater resistance to destocking.

Various signs indicate that although clothing sellers successfully transferred inventory during “Double Eleven”, for cloth bosses, this wave of dividends has not yet been transferred to orders. At present, Although some manufacturers in the market have received supplementary orders, the scope is not large. There are still many textile bosses who say that their lives are not satisfactory!

I expected the market to take off in November, but… it crashed!

Recently, a boss who makes imitation silk cried to the editor: “Originally, everyone expected that women’s imitation silk would take off in November, but it crashed before it took off. The machine is ready.”

The imitation silk series can be said to be the fabric variety most affected by the epidemic this year.

On the one hand, because the weaving process is simple and the market production capacity is relatively large, the imitation silk series showed a pattern of overcapacity last year. Many textile bosses are looking forward to reducing their inventory this year. Clear one clear. As a result, under the influence of the epidemic, the market for spring and summer clothing fabrics “disappeared”, causing what was supposed to be the peak sales season for imitation silk to be aborted.

On the other hand, with the advancement of the times, consumers’ aesthetics are also changing. In the past, ordinary chiffon, hemp, high-end products such as high-end products can no longer meet the needs of brand clothing. With the pursuit of fashion, demand has weakened, while imitation acetate, rayon, rayon and other fabrics have been relatively prominent in transactions this year.

“Currently, there are only a handful of popular varieties of imitation silk. The so-called easy-to-sell varieties can only allow the factory to earn some money to support the workers. This year, we are really tired of producing imitation silk products.” The textile boss express.

In addition to the sharp contraction in order volume, the price of artificial silk fell It has also dropped significantly compared with previous years. The current price of 24-twist 75D chiffon has dropped to about 2.20 yuan/meter, which is a decrease of nearly 40% compared with last year. The raw material polyester filament FDY75D has dropped by about 20%. It can be seen that the price drop of gray cloth has obviously exceeded the increase of raw materials. No wonder the bosses are shouting with their hearts: If you can feed the workers this year, you are already making money!

The early positive effects have dissipated, and the market outlook is still mixed with bulls and bears

In fact, imitation silk manufacturers are currently facing The dilemma is just a “microcosm”. For most manufacturing companies, after a wave of market conditions in October, the market has once again entered a tepid state. The market transactions have basically come to an end. Although orders have arrived slightly, they cannot satisfy most textile bosses. , there are signs of increase in gray fabric inventory, which also indicates this pressure.

Currently, many textile bosses are placing their hope on the re-release of domestic sales momentum during Double Eleven and Double Twelve, as well as the shortened lockdown period in European countries due to vaccine progress, and economic activities can resume as usual. But judging from the recent news coming out of the market, the days ahead may still be tough.

1. Due to the accelerated spread of the epidemic in the United States, Biden’s new crown epidemic adviser recommended closing the country for 4-6 weeks, that is, Shut down the U.S. economy again to fight the epidemic.

2. The Trump administration suddenly announced an executive order on the 12th, prohibiting U.S. investors from investing in companies owned or controlled by the Chinese military. This may affect, among others, 31 Chinese companies including China Telecom, China Mobile, and Hikvision. This is the latest move by the Trump administration to increase pressure on China after the US election.

It can be seen that the foreign trade market is still under constant pressure, but fortunately, for “food, clothing, housing and transportation”, the rigid demand for clothing still exists. At present, the market price of the entire industry chain is at a historical low. As long as the market releases a “recovery” signal flare, a slow recovery of the market can still be expected!

</p