Introduction: Affected by the spread of the global epidemic, the export of the textile and garment industry downstream of polyester is restricted, and the demand pressure of the chemical fiber industry chain is transmitted upward step by step. Under the pessimistic expectations of market participants, the market buying There is insufficient gas, and the spot price of ethylene glycol continues to fall.

Data source: Jin Lianchuang

International crude oil continues to fall, and ethylene glycol cost support collapses

In early March, OPEC+ failed to negotiate production cuts, and oil-producing countries represented by Tsarist Russia officially started an “oil price war.” In just 15 days, WTI and Brent fell from US$46.78 and US$51.13/barrel on the 4th to US$20.37 and US$24.88/barrel on the 18th, a decrease of 56.5% and 51.3% respectively. Not only did the price of crude oil fall by more than half, but at the closing price on the 9th alone, the price of crude oil futures hit the largest single-day drop since the Gulf War in 1991. This decline can be said to have set a new historical record.

Inventories continue to rise, hitting historical highs

data Source: Jin Lianchuang

The latest data shows: East China’s ethylene glycol inventory totaled 1.006 million tons on March 26, an increase of 65,000 tons from March 19, of which 604,000 tons were in Zhangjiagang ( The average daily shipment of a certain warehouse is 4,475 tons); Taicang 160,000 tons; Ningbo 106,000 tons; Jiangyin 76,000 tons, and Yangshan 60,000 tons.

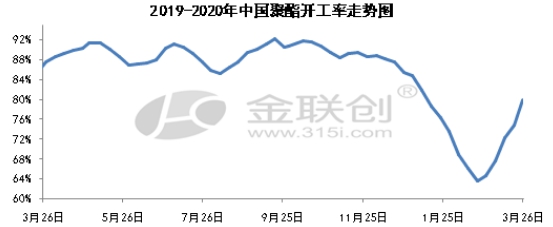

Polyester downstream exports are restricted, and there is a large downside space for construction

Data source: Jin Lianchuang

This week, international crude oil continued to rebound slightly. However, as the global COVID-19 epidemic intensified, the polyester and its downstream export markets were cold. In addition, domestic demand recovered slowly, and the industry’s The market outlook is pessimistic, so the polyester market continues to decline. However, polyester units that were shut down in the early stage have restarted, resulting in the polyester comprehensive operating rate continuing to rise this week. In the future, polyester factory inventories are high and downstream demand is difficult to recover. It is difficult for polyester factory inventories to be smoothly transferred to downstream. It is expected that in April, the comprehensive operating rate of polyester may have some room for downside.

It is expected that the ethylene glycol market will continue to be weak next week. Although the panic caused by the huge earthquake in the financial market has improved, the epidemic is still in the fermentation stage, external uncertainties still exist, and the impact on the economy is difficult to repair quickly in the short term. International energy is still hovering at the bottom, and ethylene glycol is expected to Maintain low levels and wait for news guidance. External uncertainties still exist, and the impact on the economy is difficult to repair quickly in the short term. International energy is still hovering at the bottom, and ethylene glycol is expected to maintain low operation, waiting for news guidance.

</p