Market Profile

Short comment

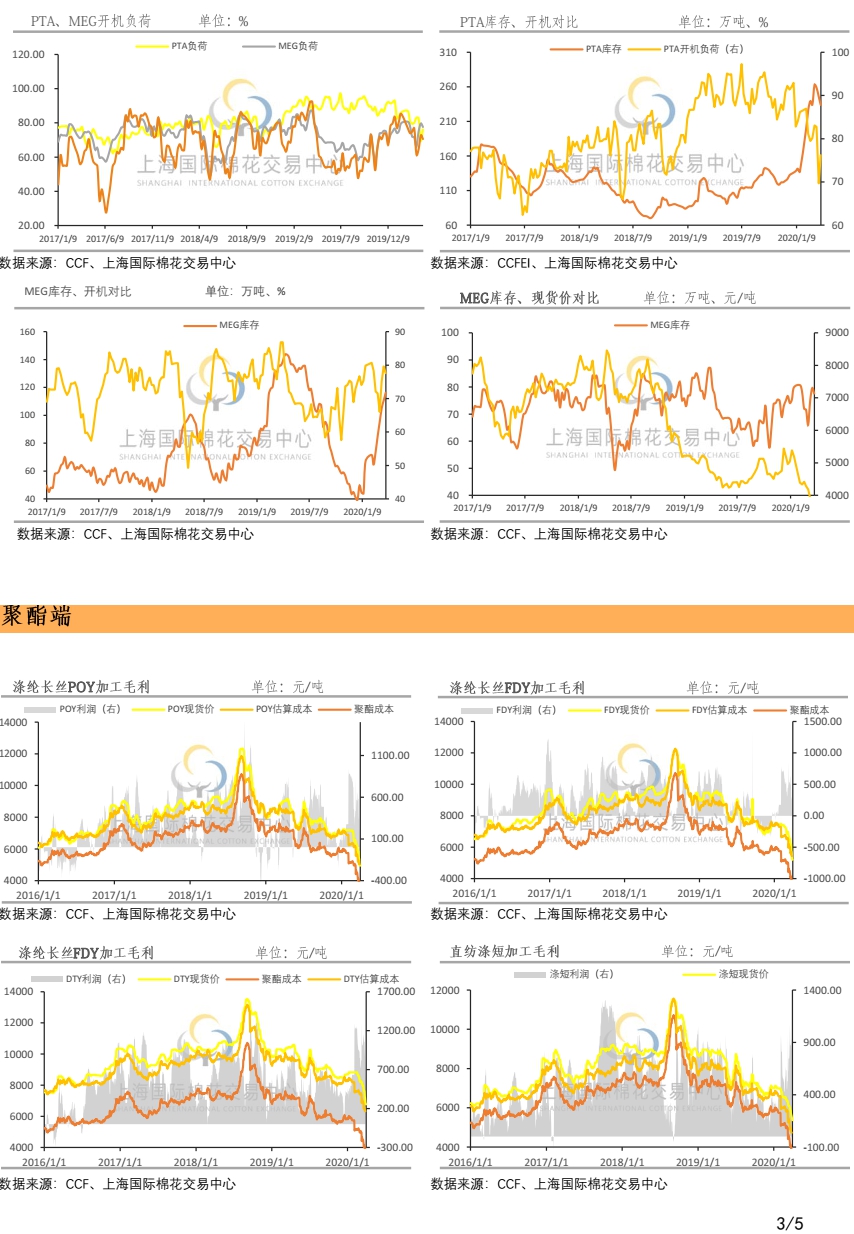

After stabilizing in the external market last week, crude oil continued to fall, with Brent crude oil closing at US$24.93/barrel and WTI closing at US$21.51/barrel. Naphtha fell sharply, PX continued to hit the bottom, and PTA and MEG fell below the support line and hit new lows repeatedly. The PX-naphtha price difference remained low, and the PTA processing price difference strengthened slightly. Downstream polyester products also fell sharply, and the market had a strong wait-and-see sentiment. Replenishment was mainly for urgent needs. Polyester inventory fell slightly, and the overall inventory was at an all-time high. PTA inventories have declined slightly but still remain at historically high levels. MEG inventories have increased slightly and continue to climb towards historical highs. Last week, the profits of bottle flakes and polyester staple fiber increased significantly, but the profits of filament yarn dropped significantly. At present, the overseas epidemic has entered a period of concentrated outbreak, with widespread panic and a great impact on the macro economy. The loss of terminal demand is obvious, and the impact of high inventory is superimposed. It is difficult for polyester raw materials to make a big difference.

Main risk points

OPEC+ reaches agreement on production reduction, epidemic progress

</p