Market Profile

View Strategy

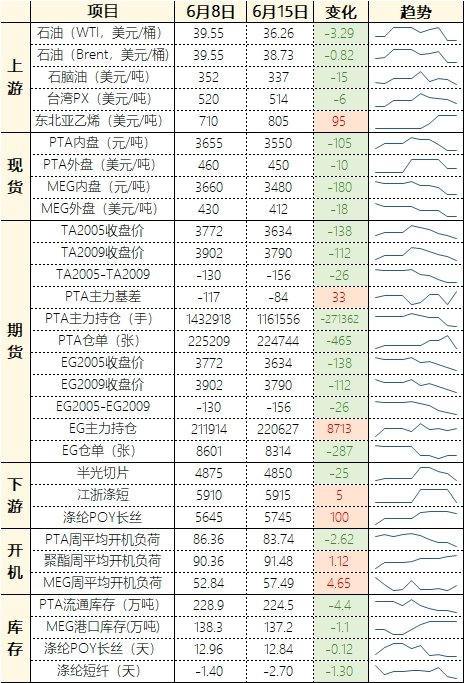

Crude oil rose first and then fell last week. Brent oil gradually weakened after hitting a recent high of 43.41. In 2019, 6.1 million tons of PX production capacity was put into production in China. The supply of PX increased significantly in 2019, resulting in PX profits remaining low. This week, PX followed the rise in crude oil prices and returned to above US$500/ton, with processing fees recovering slightly. Fuhai Chuang’s 4.5 million tons unit has reduced its load by 50% due to alkali washing and is expected to recover in the near future. Sichuan Energy Investment’s load has increased to full capacity, and demand remains high. Supply and demand have shown a slight destocking. According to CCFEI statistics, PTA circulation inventory has destocked slightly. 44,000 tons to 2.245 million tons. Jiangyin Hanbang’s 2.2 million ton unit is expected to restart this week, and PTA is expected to accumulate inventory slightly.

In terms of MEG, naphtha prices rebounded during the week, and ethylene glycol losses further expanded, among which ethylene losses were more serious. Domestic coal-to-ethylene glycol plants remain operating at a low level, and some companies that plan to restart are slightly delayed. According to CCF statistics, as of the 15th, the MEG port inventory in the main port area of East China was approximately 1.372 million tons, a decrease of 11,000 tons from the previous period.

Last week, Rongsheng’s 400,000-ton/year maintenance unit restarted, Fujian Yijin’s new 100,000-ton/year unit was put into operation, and the average weekly operating rate of polyester increased by 1.12% to 91.48%. Although there is a partial increase in production and sales, due to limited demand, the overall production and sales of polyester filament yarns are average. The number of orders is still dominated by small orders, with fewer large orders.

Generally speaking, polyester raw materials are in short-term or weak conditions.

Strategic suggestions

PTA wait and see, MEG sells short on highs (for reference only)

Main risk points

1. The progress of the epidemic has triggered a sharp decline in downstream demand, which will compress raw material profits upward.

2. OPEC+’s ineffective implementation of production cuts has triggered a further collapse of the center of gravity of crude oil prices.

</p