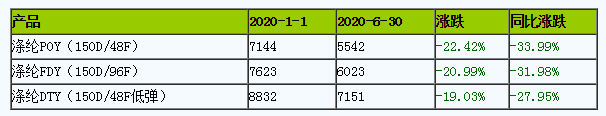

In the first half of 2020, the domestic polyester filament market prices for various products showed an overall downward trend, among which polyester POY fell most significantly, with a half-year decline of 22.42 %, followed by polyester FDY, which fell by 20.99%, and polyester DTY, which fell by 19.03%.

The average market price of polyester filament from January to June 2020, unit: yuan/ton

The first phase: from January to early February, some factories enter the traditional Spring Festival maintenance state during the traditional Spring Festival holiday. At the same time, due to the spread of health emergencies and safety incidents, downstream production Companies have stopped operations one after another and logistics have come to a standstill. The demand side has entered a “vacuum period”. Especially since mid-February, prices have plummeted. Polyester POY (150D/48F) fell to an average market price of 4,844 yuan/ton on April 2. It hit the lowest price in the past 10 years, falling 63.42%.

Second stage: After the Qingming Festival, the downstream polyester filament yarn market experienced a historic wave of bargain hunting. Factories destocked significantly, inventory pressure eased and production enthusiasm increased, so the price also ushered in a small wave. rebound. Unfortunately, from mid-April to the end of April, as crude oil prices plummeted and fell into negative values, the panic mentality in the downstream completely covered up speculative purchases. The cost of polyester filament fell, inventory was under pressure, and prices fell again.

The third stage: starting from the end of April, the price of polyester filament has started to recover, mainly due to the rising demand for domestic polyester protective clothing, triggering a wave of downstream purchases. At the same time, the crude oil market has experienced an oversupply contraction. As expected, prices have shown a volatile and rising pattern, and the cost side has also formed a certain support. However, due to the traditional domestic off-season and lackluster exports, downstream weaving companies have gradually become more rational in their purchases due to tight cash flow, and demand has been sluggish since mid-June and has continued to decline.

The commissioning of new domestic polyester plants in the first half of 2020, unit: 10,000 tons

From a production capacity perspective, despite the continued low market, the growth rate of new polyester and polyester filament production capacity increased significantly during the same period throughout the first half of 2020. The total new domestic polyester production capacity Of the 2.93 million tons, new polyester filament production totaled 1.2 million tons, accounting for 41% of the total new polyester production. By comparison, the new domestic polyester production in 2019 totaled 1.37 million tons, of which new polyester filament production totaled 530,000 tons, accounting for 38.7% of the total new polyester production that year. From the perspective of the industry’s long-term strategy, domestic leading polyester companies are still “going against the trend” and implementing their previous production plans. First, they will accelerate the industrial layout of refining and polyester integration, with strong capital and risk control capabilities, and through their own corporate strength. Expanding corporate production capacity further increases industry share and squeezes the living space of small and medium-sized enterprises; secondly, most of the products put into production are unconventional products with certain differentiation to enrich their own production lines.

In the first half of 2020, the trend of polyester start-up load showed a decrease first and then an increase. It gradually returned to normal levels amid slight fluctuations. After the traditional Spring Festival holiday and the spread of health and safety emergencies, factories have implemented production cuts under the pressure of high inventory, and the operating load once dropped to a historical low of around 6. Then, with the gradual resumption of work by downstream weaving companies and the partial recovery of logistics, the demand port was released, further driving the start-up load of polyester filament to increase. In addition, against the background of the Qingming Festival, the downstream inventory decompression and high production, the enthusiasm of factory production has been continuously improved, and the current total operation has reached a high of more than 86%.

The raw material PTA market first fell and then rose. As of June 30, the average market price was 3617 Yuan/ton, down 27.35% from the beginning of the year and down 43.18% year-on-year. In the first stage, crude oil prices showed a cliff-like decline mainly due to public safety and health incidents. Affected by this, PTA continued to decline and fell to 3,068 yuan/ton on April 22, setting a new historical low. Especially in February, limited transportation and insufficient demand caused PTA inventory to accumulate significantly. The accumulated inventory in that month reached nearly 1 million tons. Entering the second stage, although supply and demand pressures have obviously continued to accumulate, and social inventories have remained above 3.7 million tons since April, as crude oil strengthens, positive support appears on the cost side, and the overall upward trend is narrow.

In the downstream terminal textile and weaving market, affected by the Spring Festival holiday, the loom operating rate in Jiangsu and Zhejiang dropped to around 0.6% in early February. As companies gradually resumed work, it rose to around 70% in mid-March. Slow demand recovery and insufficient order follow-up have led many weaving manufacturers to reduce their workload and production to 40%. Entering May, the order situation has only partially improved, and the overall market trend is still unclear. The off-season atmosphere in June gradually deepened, and it was even more difficult during the off-season in a special year. Demand was sluggish and transactions were light, falling to around 60%. At present, conventional products are unsaleable, the market has no bright spots to support it, and it is difficult to sell products, causing weaving manufacturers to continue to enter an inventory accumulation cycle.�. Judging from the current market conditions, domestic trade competition is fierce and foreign trade recovery is difficult. Weaving manufacturers will continue to accumulate inventory. If there is no substantial change in the market outlook, manufacturers’ operating rates may further decline. Currently, the inventory of gray fabrics in Jiangsu and Zhejiang is about 43 days, compared with about 41 days in the same period last year, and only about 25 days in the same period in 2018.

Textile foreign trade exports are still under great pressure. According to the latest statistics from the General Administration of Customs of China, in May 2020, my country’s textile and clothing exports were US$29.554 billion, a month-on-month increase of 38.36%, of which The export volume of clothing (including clothing and clothing accessories) was US$8.9057 billion, a year-on-year decrease of 26.93%. From January to May 2020, my country’s cumulative export volume of textiles and clothing was US$97.965 billion, a year-on-year decrease of 0.80%, of which the cumulative export volume of clothing was US$38.2131 billion, a year-on-year decrease of 22.80%.

Business News analyst Xia Ting believes that the current crude oil production reduction cycle has formed a certain support, but for PTA, the inventory is still at a high level, which is not enough to reverse the mid- to long-term PTA industry with excess supply and demand. The current situation of high inventory is difficult to resolve, and the PTA market is more likely to weaken in the future. At the same time, in the short term, the traditional off-season characteristics of textile terminals are becoming more and more obvious. Domestic sales demand is sluggish, and it is difficult to make breakthroughs in export sales. If new equipment is added and put into production, the price of polyester filament is more likely to fluctuate downward in the second half of the year.

</p