Introduction: In the first half of 2020, after experiencing ups and downs, the price of polyester bottle flakes fell to a record low, attracting many OTC funds to enter the market to stock up. Although the price of polyester bottle flakes is at a historical low, it has become a bright pearl among polyester products with huge profit margins.

1. Cost-end push for polyester Bottle flakes fell below the lowest price in history

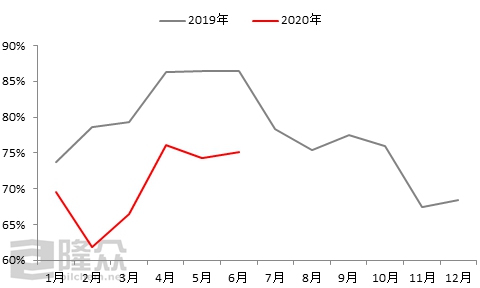

In the first half of 2020, black swan incidents occurred frequently, coupled with the spread of public health incidents at home and abroad, US oil once fell to negative values, and raw material PTA With MEG futures prices plunging one after another, the price of polyester bottle flakes fell rapidly. As of June 30, polyester bottle flakes and water bottle materials in East China were 5,450 yuan/ton, a decrease of 1,100 yuan/ton, or 16.89%, from the price at the end of 2019; compared with the same period last year, the price dropped by 2,250 yuan/ton, a decrease of 29.22%; in 2020 The average price in the first half of the year was 5,767 yuan/ton, a decrease of 2,263 yuan/ton compared with the same period last year, an increase of 28.18%. Among them, the trough price of 5,100 yuan/ton appeared at the end of March, falling below historical lows.

Specifically, in the first quarter, external news continued to ferment, which was negative for the bottle tablet market. Early US air strikes resulted in the death of senior Iranian officials, and the situation in the Middle East suddenly became tense. Driven by crude oil, the price of polyester bottle flakes rose. During the holidays, due to the impact of public health events in China, transportation was closed and logistics was not smooth, and the bottle tablet market was overall closed. Entering February, PTA and MEG on the raw material side have plunged sharply, and the price of polyester bottle flakes has dropped significantly. However, the downstream small and medium-sized processing enterprises are in the shutdown stage, the soft drink industry is operating at a low level, the overall demand is reduced, and logistics is restricted, and the inventories of bottle chip manufacturers have begun to rise. In March, Russia rejected OPEC’s proposal to jointly reduce production by 1.5 million barrels per day, causing crude oil to plummet. Subsequently, the Federal Reserve lowered interest rates to zero, triggering market panic. In addition, Saudi Arabia planned to increase supply in April, and international oil prices plummeted again. The cost-end support collapsed, and the price of polyester bottle flakes fell below the historical low to 5,100 yuan/ton.

In the second quarter, overseas public health incidents spread rapidly, and the market was worried about reduced demand. The WTI May contract fell into negative numbers, and the industry had a strong bearish mentality. The market price of polyester bottle flakes is at a historical low, attracting a large amount of idle funds to enter the market and stock up. Several units were unexpectedly shut down for maintenance (Chenggao 1.2 million tons, Shanghai Yuanfang Large Line, Anyang Chemical shut down for maintenance due to environmental problems, Wuliangye 150,000 tons). On the demand side, demand in the sheet-protective supplies area is booming, and the spot market for bottle tablets is tightening. In May, a major PTA factory stopped unexpectedly, which supported the price fluctuation of polyester bottle flakes. After entering June, the demand side showed weakness, and the price range of bottle flakes fluctuated and the price was weak. As of June 30, the price of polyester bottle flakes and water bottle material in East China was 5,450 yuan/ton.

Figure 1 2019-2020 polyester bottle flakes market price trend in East China:

2. Demand performance exceeded expectations, and polyester bottle flake stocks fell from highs

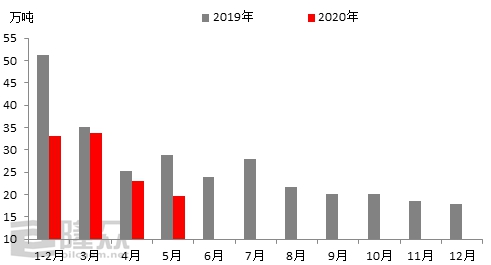

Domestic Spring Festival After the holidays, due to the impact of public health incidents, domestic transportation was restricted and logistics was not smooth, causing bottle tablet manufacturers to hinder their shipments. The personnel of downstream processing enterprises cannot be in place in time, the overall industry operation is at a low level, demand is reduced, and the inventory of bottle flake manufacturers is close to a high of 900,000 tons. As major manufacturers take the initiative to reduce production and load, and a total of 2.05 million tons/year production capacity equipment is unexpectedly shut down, spot supply is tightening. At the same time, with the improvement of domestic demand, the consumption of sheet materials increased significantly, and the inventory of bottle sheet manufacturers fell from high levels at the end of April.

Figure 2 Month-end inventory trend chart of polyester bottle flake manufacturers

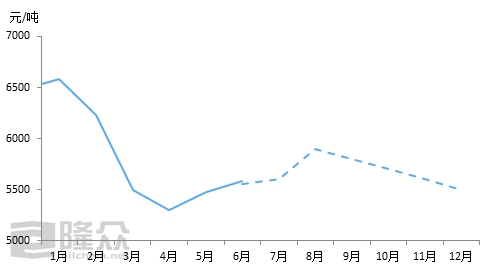

3. Spot supply is tightening, and polyester bottle flakes have sufficient profit margins

From January to June 2020, polyester The average profit of bottle flakes is 465 yuan/ton, an increase of 221.3 yuan/ton compared with the same period last year, an increase of 91.81%. On the one hand, the prices of PTA and MEG on the raw material side have fallen sharply. On the other hand, due to reduced terminal demand and poor logistics, the inventory of polyester bottle flake manufacturers entered February at a high level. The industry began to take the initiative to reduce production and load, and the industry’s operating capacity once dropped to around 59%. At the end of March and the beginning of April, when the traffic returned to highways, freight charges were generally low. The large amount of shipment demand accumulated in the early stage began to be released intensively. Bottle flakes factories entered the peak season for shipments. The market supply of spot goods became tight. Manufacturers had a strong price push. The market price of bottle flakes strong.

Figure 3 Comparison of profit margins of polyester bottle flakes in 2019-2020:

4. Domestic demand has recovered, and the start-up of the polyester bottle flake industry has steadily increased

Affected by public health events, The overall monthly operating capacity of polyester bottle flake manufacturers dropped from 69.46% to 62.17% in February. A decrease of 16.1 percentage points from the same period last year. In mid-March, as downstream companies quickly resumed work and production, the load of bottle tablet factories began to steadily rebound. As of June 30, the overall operating capacity of the bottle tablet industry increased to 76.31%. From January to June 2020, a total of 1.2 million tons of new production capacity were put into operation (Chongqing Wankai 600,000 tons, Dalian Yisheng Phase II 350,000 tons, Hainan Yisheng 250,000 tons). The unexpected shutdown production capacity totals 2.05 million tons (Jiangyin Chenggao 1.2 million tons, Anyang Chemical 300,000 tons, Wuliangye 150,000 tons, Shanghai Yuanfang 400,000 tons).�From January to June 2020, the overall operating capacity of the bottle tablet industry was 70.56%, a decrease of 11.26 percentage points compared with the same period last year. The output of the bottle flakes industry was 4.2757 million tons, a decrease of 241,800 tons or 5.35% compared with the same period last year.

Figure 4 Comparison of the start-up of the polyester bottle flake industry in 2019-2020:

5. The overseas epidemic is spreading rapidly and there are signs of a second recurrence, and export volume has dropped significantly year-on-year

According to customs Data show that from January to May 2020, China’s export volume of polyester bottle flakes (39076110) accumulated to 1.9042 million tons, a decrease of 311,400 tons or 22.15% compared with the same period last year. Affected by the public health incident, domestic roads were closed in February and external shipping was restricted, which resulted in the postponement of some February orders to March. As a result, exports decreased significantly from January to February. In mid-to-late March, the overseas epidemic spread rapidly, and foreign trade orders were significantly reduced or delayed, dragging down exports from April to May. Overseas, the global epidemic is still in a worsening stage, and the epidemic broke out again in the United States at the end of June. The volume of foreign trade orders received by bottle tablet manufacturers has shrunk significantly.

Figure 5 Comparison of export volume of polyester bottle flakes from 2019 to 2020:

6. Outlook for the second half of the year for polyester bottle flakes

The bumpy first half of the year has quietly ended, and the second half of the year will be full of excitement. The market situation of ester bottle tablets is hardly optimistic. July-August is the peak season for terminal demand, but as the soft drink industry has locked in many orders for raw materials this year, new quantities are scarce. In addition, when the price was low in the early stage, many small and medium-sized processing companies had stockpiles, and their demand consumption capacity was limited, which restricted the price increase of polyester bottle flakes to a certain extent. In September, domestic demand enters the off-season. If overseas orders are boosted, the bottle tablet market can still be supported. In the fourth quarter, reduced demand may drag down the bottle tablet market. Overall, the polyester bottle flake market may show a trend of rising first and then declining in the second half of the year.

6.1 Supply side:

Hainan Yisheng another 250,000 tons The new bottle tablet device is scheduled to be put into operation in July, and no other new production capacity will be launched. However, the restarted production capacity should not be underestimated: Chenggao 1.2 million tons, Anyang 300,000 tons, Shanghai Yuanfang Large Line 400,000 tons, and Wuliangye 150,000 tons. Production will be released in August as these units start up. By then, the tight spot situation will be alleviated, and may even gradually show a loosening trend. Changes in the supply and demand structure will bring certain pressure to polyester bottle flakes. However, some mainstream manufacturers have received orders until November. With a stable mentality, the probability of low-price shipments is small.

Figure 6 Comparison of polyester bottle flake production in 2019-2020:

6.2 Demand side

In the second half of the year, domestic terminal demand is still in the peak season from July to August, and most mainstream Soft drink factory orders for the year have been locked in advance. With the industry operating at a high rate, shipment demand is stable and replenishment demand is small. However, the loose inventory of polyester bottle flake factories will support the stable mentality of manufacturers and support the price trend of polyester bottle flakes in the short term. After entering the off-season of demand in the soft drink industry, it is difficult to continue to follow up on the procurement of sheet and oil raw materials. After the demand side weakens, it will drag down the correction of the bottle chip market. The situation of foreign trade orders depends on the epidemic control situation in overseas countries. Compared with the first half of the year, there should be a certain degree of recovery.

6.3 Market mentality survey

Longzhong Information conducted a survey on 20 companies across the country Sample companies launched a survey on the forecast trend of the polyester bottle flake market in the second half of the year, and 41% of them held pessimistic expectations, mainly due to sluggish demand performance. On the one hand, foreign trade orders have not been relieved, and on the other hand, domestic trade demand is weak. Mainstream soft drink factories have locked in raw materials in advance this year, while demand for soft drinks accounts for nearly 70% of the consumption of bottle chips, while growth in other sheet materials and oils is smaller. Supply will increase significantly in the second half of the year, but with weak demand, the trend of polyester bottle flakes is unlikely to change. Therefore, most companies in the market are bearish on the market outlook. About 36% of companies hold optimistic expectations, believing that it is currently the peak demand season, and the raw material-end PTA is supported by the “Golden Nine and Silver Ten” of terminal textiles, and the third quarter may be relatively strong. In the fourth quarter, as some mainstream manufacturers have basically completed their orders for this year and have a strong price support mentality, the downward space for bottle tablet prices is limited. The remaining 23% of companies hold a neutral attitude, believing that the performance of bottle flakes is no more than this during the peak demand season. With cost support in the fourth quarter, the downward space for bottle flakes is limited. In the second half of the year, the bottle flakes market is in a dilemma, with range fluctuations.

Figure 7 Polyester bottle flake market trend forecast in the second half of the year:

Polyester bottle flakes have always been the dominant product at the raw material end, and PTA’s overall sales in the second half of the year were weak and volatile (see PTA’s 2020 semi-annual report for details). In summary, Longzhong Information believes that the trend of polyester bottle flakes in the second half of the year may be high and then low. It is expected that the price of polyester bottle flakes in the second half of the year will range from 5,800 to 5,500 yuan/ton.

Figure 8 Price trend forecast for polyester bottle flakes in East China market in the second half of 2020:

ight=auto data-preview-src=”” data-preview-group=”1″ src=”https://www.tradetextile.com/wp-content/uploads/2023/vrbmh4qyw1f.jpg”>

</p