During the period from May 20 to June 8, 2020, the International Textile Federation conducted the fourth International Textile Federation COVID-19 impact survey on Itex members, affiliated companies and associations to understand the impact of the COVID-19 pandemic. Impact on global textile value chains. About 600 companies from around the world participated in the survey.

Globally, current orders continue to decline by more than 40% on average (Figure 1). The proportion of order cancellations and postponements ranges between 30% (Southeast Asia) and 55% (South America).

Impact of the COVID-19 pandemic on orders by region

Figure 1: Globally , orders are currently down by an average of 42%.

Looking at different sectors of the textile value chain, from spinning mills to garment manufacturers, orders have been significantly reduced in all sectors (Figure 2).

Impact of the COVID-19 pandemic on orders by production sector

Figure 2: Global Textiles The order reduction for all production sectors of the value chain ranged between 37% and 46%.

Compared with 2019, the expected turnover in 2020 has remained unchanged since the third International Textile Federation COVID-19 epidemic survey. Overall, the turnover of global companies is expected to drop by an average of 32% in 2020. The projected turnover decline in different regions ranges from 22% (Southeast Asia) to 36% (East Asia) (Figure 3).

Impact of the COVID-19 pandemic on turnover in 2020 (by region, compared with 2019)

Figure 3: Global Within the range, turnover is expected to fall by an average of 32% in 2020 (compared to 2019).

Concerning the expected turnover in 2020, the performance of the integrated integrated producers seems to be slightly better, with a turnover expected to fall by 26%, while the other sectors expect a turnover in 2020 The decline ranged between 31% and 34% (Figure 4).

Impact of the COVID-19 pandemic on turnover in 2020 (by production sector, compared with 2019)

Figure 4: Turnover of various sectors of the global textile value chain in 2020

The decline ranged between 26% and 34%.

When asked when turnover will return to pre-crisis levels again, the majority of participants (23%) expected this to happen in the first quarter of 2021, followed by 21% of participants expect this to happen in the second quarter of 2021, and another 14% expect it to be the third quarter of 2021. Nonetheless, 20% of companies expect a faster recovery in the fourth quarter of 2020 (Figure 5).

Companies in different regions and sectors have little difference in their expectations for recovery speed. Most businesses expect a return to pre-crisis levels in the first or second quarter of 2021.

When will turnover return to pre-crisis levels?

Figure 5: 44% of people expect that in the first or second quarter of 2021

reached pre-crisis levels again.

The survey also shows that since the beginning of the crisis, most companies in all aspects of the textile value chain have had to cancel/postpone orders on their own. In the spinning industry, 50% of companies canceled/postponed orders, while in the weaving/knitting industry, this number even reached 83% (Figure 6).

Figure 6: Percentage of companies that had to cancel/postpone orders because orders were canceled/postponed.

On this basis, the survey also asked how corporate orders were canceled/postponed? Depending on the industry segment, 26% to 40% of businesses were not informed of order cancellations/postponements in a collaborative manner. It is worth noting that comprehensive integrated producers (26%) are significantly less affected than other sectors (Figure 7).

Proportion of orders canceled by customers without warning/discussion (by production department)

Figure 7 : Which customers notify sellers/manufacturers of order cancellations/delays without warning/discussion?

When it comes to regional differences, 43% of businesses in North America received no cancellation/postponement warning, compared to only 20% in South America and 21% in Southeast Asia (see below picture).

Proportion of orders canceled by customers without warning/discussion (by region)

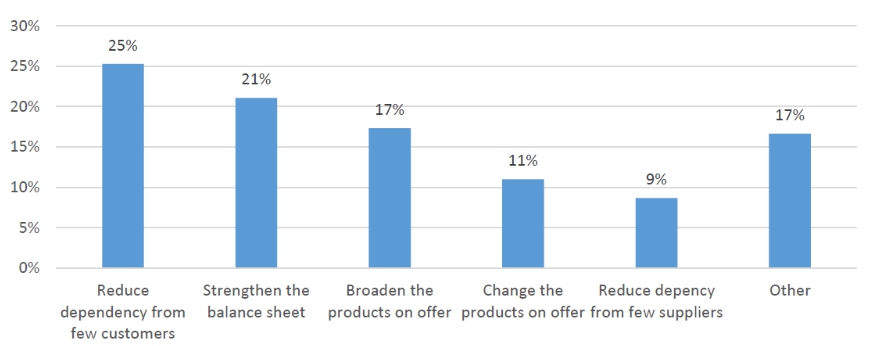

When asked When asked what lessons companies have learned from the crisis (Figure 8), the most important lesson is “reduce dependence on a small number of customers” (25%), followed by “strengthening the balance sheet” (21%) and “increasing product offerings” variety” (17%), “change the products offered” (11%) and “reduce��Reliance on a few suppliers” (9%).

What lessons have been learned from the crisis?

Figure 8: Reducing reliance on a small number of customers is the most important lesson learned from the crisis.

In addition to the above lessons, survey participants also mentioned “other Lessons learned” such as:

★ A higher degree of flexibility to meet different needs, ★ Working with reliable and sustainable partners, ★ Developing more innovative products, ★ Improved risk management.

Finally, participants noted that the industry has found itself in overcapacity as demand is significantly lower than before the crisis and, therefore, consolidation is expected. Own Businesses with strong balance sheets, innovative products, diverse and flexible operations, and different customers in different regional markets are likely to emerge stronger from this crisis.</p