Introduction: In the first half of the year, with the trade war coming to an end and the signing of the first phase agreement between China and the United States, it is expected that the shackles of foreign trade will be lifted, and the stable domestic demand will surely push the textile industry onto a broad road. Market participants are looking at the ripples I am full of expectations for 2020. However, an epidemic detonated the whole world, and the world economy faltered on the road to recovery. From crude oil plummeting to polyester and cotton, the decline penetrated into yarn and gray fabrics until it reached the back end. How can we independently bear the shrinking domestic trade environment when foreign trade is hampered by the epidemic? On the road to survival, some companies are “missing arms and legs”, while some companies have directly entered the “ICU”. In the second half of the year, the volatile epidemic continued to restrict global economic recovery and coupled with the geopolitical crisis, the yarn industry still faced many difficulties.

1. Trends: The mismatch between market supply and demand for yarn has repeatedly reached new lows

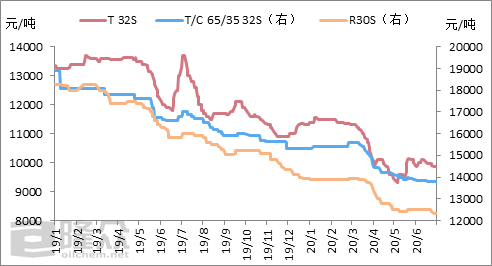

Pure polyester Yarn: In the first half of the year, the market price of pure polyester yarn showed an “L”-shaped trend. Under the two-way pressure of high raw materials and lack of demand, profits were suppressed. Since the outbreak of the global epidemic in March, export orders have been canceled or postponed. Domestic market demand has also It was also weakened by the extension of terminal channels. Although the terminal market in Europe and the United States picked up in the second quarter, some export orders began to recover, but there was a larger decline in order volume compared with the same period in previous years. Affected by the downward shift in the cost end of polyester staple fiber, the operating space of pure polyester yarn has also declined, hitting new historical lows in the past five years. The price high this year occurred in January, at 11,550 yuan/ton, and the price low during the year occurred in May, at 9,300 yuan/ton. In the first half of the year, the average market price of ring-spun T32S was 10,575 yuan/ton, down 27.35% year-on-year. Polyester-cotton yarn: Under the disruption of the epidemic, demand was damaged and costs collapsed. Polyester-cotton yarn fell below the highest level in ten years, and spinning profits were squeezed. In 2019, under the constraints of trade disputes and the lack of effective demand extension, the yarn market followed the amplitude of raw materials and fell all the way down. In 2020, the epidemic has combined with the recessionary economic situation, and the downgrade of consumption is a foregone conclusion. Although the street stall economy has emerged as the times require, it is difficult to change the weak demand environment. In the first half of the year, the polyester-cotton yarn market showed a “へ”-shaped trend. By the end of June, the average price of T/C 65/35 32S dropped to 13,800 yuan/ton, a decrease of 1,500 yuan/ton from the beginning of the year, and a year-on-year decrease of -17.86%. Rayon yarn: There is a strong positive correlation between the price trends of rayon yarn and raw material viscose staple fiber. In the past, the price of rayon yarn was the driven axis, but with the increase in viscose staple fiber production capacity and weak demand, the market turned In a buyer’s market, the price of rayon yarn has become the driving force for both. Therefore, although viscose staple fiber has repeatedly tried to rebound since 2019, it has finally returned to the downward trend due to the stability and weakness of yarn prices.

2. Supply: Insufficient demand has forced prices to suppress production and consumption stocks

1. Nationwide Yarn industry start-up: In the first half of the year, the national yarn industry start-up showed a wave-like trend. Under the influence of the epidemic, except for companies that provide epidemic prevention raw materials, yarn companies across the country have resumed work since February 10. However, considering the severity of the epidemic and the status of workers returning to work, companies in some areas did not resume work until March. With the support of early signed orders, the yarn industry’s start-up has climbed to 70%. However, the good times did not last long. With the outbreak of overseas epidemics, destroyed orders were common. The industry’s supply pressure was offset by sluggish demand. In order to alleviate the dilemma, Qingming, May Day, and During the busy farming season and the Dragon Boat Festival, some companies cut production or reduced production. When sales fell short of production, yarn companies even stopped once a month. By the end of June, the national yarn production rate dropped to 64.50%, -11.04 percentage points year-on-year. 2. Inventory in the yarn industry: Under the epidemic situation, the industry’s oversupply, weak demand, and insufficient funds have strangled the throats of yarn companies. In this difficult situation, inventory is the basic condition for measuring the company’s capital flow and whether it can rationally adjust production and sales. , related to the lifeblood of enterprise operations.

Pure polyester yarn: From January to June 2020, the average product inventory of domestic pure polyester yarn companies was 10.28 days, a year-on-year increase of 3.54 days. Overall, in the first quarter, due to the impact of public health events, the long spring break and traffic restrictions, the work load of enterprises was at a low level. Although terminal demand is also declining, yarn companies still maintain a reasonable and controllable level. Since April, as overseas epidemics have spread, foreign trade orders have been frequently canceled or delayed, and the domestic market has gradually entered the off-season, with weak demand and inventories rising to historical highs. The average inventory low in the first half of the year was from January to 7.3 days; the inventory high was from June to 13.35 days.

Polyester-cotton yarn: In the first half of the year, the inventory of the polyester-cotton yarn industry showed a slowly rising trend. Overall, in order to avoid unnecessary pressure, more and more yarn companies choose to “pack light”. During the Spring Festival, companies were suspended for more than 20 days or even longer. With early orders,222109558010.jpg”>

In the first quarter, due to the impact of domestic epidemic prevention and control, residents’ willingness to go out for shopping declined. Most of the clothing, home textiles, and textile industries experienced a decline in revenue and performance, and experienced a return to work and orders. , The twists and turns of order reduction, textile and clothing exports have shrunk significantly, and clothing shipments have dropped by more than 20%. However, since April, with the emergency investment and construction of supporting facilities such as masks and protective clothing, its external exports of medical supplies have continued to grow. Drive the growth of textile exports. However, relying on the epidemic to drive exports is unsustainable. When the growth rate of clothing exports slows down or increases, the real market recovery will occur.

4. Clothing product retail: Although the clothing industry has low entry barriers and small investment, the market competition for consumers is fierce and excess production capacity cannot be digested. After 2018, affected by the macroeconomic growth rate Due to the slowdown and the impact of the trade war, domestic consumption has been downgraded, and retail sales of clothing, shoes, hats, needles, and textiles have shrunk. Superimposed on the intrusion of the epidemic during the year, the retail sales of clothing goods have experienced negative growth every month. From January to May, clothing sales The retail sales of commodities were 288.74 billion yuan, -25.60% year-on-year.

IV. Raw materials:

Polyester staple fiber: in low Against the background of the continuous spread of oil prices and public health incidents, the market price of polyester staple fiber has repeatedly hit new lows but has not yet reached the bottom; terminal companies have begun to reduce production and suspend production amid the slow recovery of domestic trade orders and severe shrinkage of foreign trade orders, and the market panic In the first half of the year, the market price of polyester staple fiber fell all the way from the high of 7,000 yuan/ton in January, and gradually bottomed out at 5,300 yuan/ton at the end of March. The price set a new low in ten years. The average market price in East China in the first half of the year was 6134 yuan/ton, down 27.35% year-on-year. Cotton: The cotton market had a significant rise before the Spring Festival, with the main contract reaching as high as 14,450 yuan/ton; the domestic epidemic broke out during the holiday, and the main contract of Zheng cotton fell sharply on the first day after the holiday. The lowest price was 12,130 yuan/ton, down 16.06% from the highest point before the holiday. With the gradual control and stabilization of the domestic epidemic, the spot market price of cotton futures returned to above 13,000 yuan/ton. But the good times did not last long. The external epidemic broke out in mid-to-late February. Based on worries about global trade and fear of the spread of the epidemic, U.S. crude oil fell to a negative value, and the main cotton futures fell to a low of 9890 points, which is far from the level in March 2016. The historical low is only 45 points away, and the spot trading price has dropped to around 11,000 yuan/ton. In the following more than three months, the cotton market began a long road of value return. Viscose: Viscose staple fiber has experienced four consecutive declines in 2019. During this period, the strength of the rebound has become lighter each time. It was hoped that it would be able to take a breather this year, but since the beginning of the year, public health and safety incidents broke out in the country, and the middle and lower end of the textile chain came to a halt. The phenomenon is obvious. It was not until February 10 that the industry started to gradually improve. However, not long after textile companies started production to catch up with orders, overseas fell into a deeper and more serious situation in March. This is a problem for textile companies that are highly dependent on foreign exports. For the industry, the pressure is even greater than in the early stage. At this stage, the prices of viscose staple fiber and rayon yarn have once again reached a new historical low. According to statistics from Longzhong Information, from January to June 2020, the average price of viscose staple fiber dropped to 9356.47, -25.37% year-on-year. The average price of R30S (ring spindle) in the first half of the year was 13241.71 yuan/ton, -23.96% year-on-year.

5. Outlook for the market outlook:

The pain points and difficulties restricting the development of the industry are closely related to the epidemic. It is expected that in the second half of the year, under the established environment of imbalance between supply and demand, , even if production capacity is suppressed, a series of problems such as cost, capital, and inventory will plague yarn companies for a long time. It is expected that in the game between the cost side and the demand side, the balance of the delicate balance between the two will be broken. It is advisable to change the thinking in a timely manner and pay attention to the traction effect of the news on the market trend. 1. Cost pressure hangs around the neck and low returns limit operating sentiment. International crude oil has implemented the agreement to reduce production and gradually returned to its own valuation. With a series of stimulus policies, the market has improved as the economy starts. During this period, the “V”-shaped trends of polyester, cotton, and viscose meant that yarn companies could only maintain a meager profit level or even lose money in the first half of the year. Considering that raw material costs account for about 70% of spinning costs, under high cost constraints, unsaleable yarn inventories will continue to restrict capital flow for a long time and will continue to inhibit the enthusiasm of operators. 2. Domestic demand increases slowly under the premise of consumption downgrade. High outbreaks of overseas epidemics limit global economic recovery. As the saying goes, “nine out of seven will die, eight will come back alive.” Under the influence of high temperatures and rainy weather, the domestic trade market will still be in a downturn for a long time. part. In the year of the epidemic, it is indeed difficult to increase consumption and stimulate the growth of domestic demand. However, even if it is to supplement the “Golden Nine and Silver Ten”, traditional sales methods have been restricted. The rise of electronic sales platforms and the assistance of the street stall economy may Continuous, gradual stimulation needs. 3. High outbreaks of overseas epidemics limit the recovery of the global economy. As an industry that supplies the world, China is an industry that supplies the world. With the recurrence of epidemics in Europe and the surge in epidemic numbers in the Americas and South Asia, industry players are still worried about the recovery of the foreign trade market. This move is bound to continue to suppress the textile and clothing industry. need. The slow recovery process of the foreign trade market will aggravate the competition and cooperation situation in the domestic trade market. Returning to the origin of ironmaking still requires one’s own hard work, and refining internal strength is still the primary direction.

�The slow recovery process will aggravate the competition situation in the domestic trade market. Returning to the basics of forging iron still requires one’s own hard work, and refining internal strength is still the primary direction. </p