Since the beginning of this year , the sudden new coronavirus pneumonia epidemic disrupted people’s life rhythm, and the domestic consumer market was affected. Currently, after several months of adjustment and recovery, what is the mentality of consumers? Recently, the Shanghai Office of the China Textile and Apparel Industry Federation and Donghua University conducted a sampling survey on clothing terminal consumption.

Overall, through this sample survey of end consumers, it can be found that the income of Chinese consumers has been affected to a certain extent by the impact of the COVID-19 epidemic this year. The consumption power and desire for clothing have both declined. Although everyone is optimistic about the subsequent domestic economic development, the budget for clothing consumption expenditure has declined.

The sample survey data coverage is relatively comprehensive

In recent years, with the changes in the international trade environment, my country’s textile and apparel industry increasingly relies on the domestic consumer market. In order to understand the actual demand situation and consumption trends of my country’s textile and clothing terminal market, the Shanghai Office of China Textile and Apparel Industry Federation and Donghua University have conducted a sample survey of terminal consumption every year since 2012. The survey objects are mainly concentrated in the Shanghai area.

Since this year, affected by the COVID-19 epidemic, the operations of textile and garment enterprises have encountered unprecedented difficulties. Therefore, this year’s survey scope has been expanded to the entire mainland China, and the survey content of the impact of the epidemic on consumption has been added.

A total of 1,125 samples were collected in this survey. The surveyed subjects covered ordinary consumers in all regions of the country except Tibet. The age distribution ranged from 16 to 74 years old, and most of them were concentrated in the 25-50 age group. The age group with active consumption. The questionnaire is mainly divided into three parts. The first is the basic situation of the respondents, the second is the investigation of the consumption situation of the respondents, and the third is the investigation of the impact of the epidemic.

Judging from the basic situation of the respondents, about 2/3 of the sample are women; in terms of education, 59.4% have a bachelor’s degree or above; in terms of age, 25 to 50 years old 63.4%. Therefore, most of the samples surveyed are major consumer groups and can objectively reflect the current actual situation of end consumers.

A survey of consumers’ income in 2020 found that 35.02% of consumers said that their income has declined this year, 46.04% of consumers said that their income has remained unchanged, and only 18.93% of consumers said that their income has declined. Those who expressed income increased. Compared with previous years, there has been a larger increase in consumers with reduced incomes this year. This is mainly related to the impact of this year’s new crown pneumonia epidemic.

Consumption situation has changed significantly compared with previous years

This survey on consumption situation Mainly from three aspects, one is consumption channels, the other is consumption ability, and the third is consumption habits. From the statistical data, the following information can be obtained.

From the perspective of consumption channels, online shopping has become the main shopping channel for consumers, ranking first. 50.84% of the respondents said that their main channel for purchasing clothing is through online shopping, and this proportion is increasing year by year. The second most popular shopping channel is traditional offline department stores, accounting for 26.31%, but this proportion is slowly declining year by year. Another channel chosen by consumers is clothing stores. The proportion of consumers who choose this traditional offline shopping channel is relatively stable, accounting for 17.78% this year. From the perspective of consumers from different classes by age and income, low-income and young consumers are more likely to shop online, consumers over 50 years old tend to go to department stores to buy clothing, while high-income consumers tend to Go to a clothing store.

Judging from the frequency of consumers purchasing clothing, most of them purchase clothing once a month, and this proportion is 41.07%. Most consumers spend 300 to 1,000 yuan on clothing every month, and this group of consumers accounts for 42.67%. Judging from the price of purchased clothing items, most consumers purchase clothing for 100 yuan/piece to 300 yuan/piece, accounting for 52.98%; followed by 300 yuan/piece to 1,000 yuan/piece. This proportion is 27.47%.

In the survey, 51.2% of the respondents said that their spending on clothing has decreased this year, and 25.87% of consumers said it has decreased significantly. This proportion is significantly higher than in previous years.

In the survey on the primary factors that influence consumers to buy clothing, 56.44% of consumers believe that style is the primary factor; 29.96% of consumers believe that price is the primary factor; only 8% of consumers believe that brand is the primary factor.

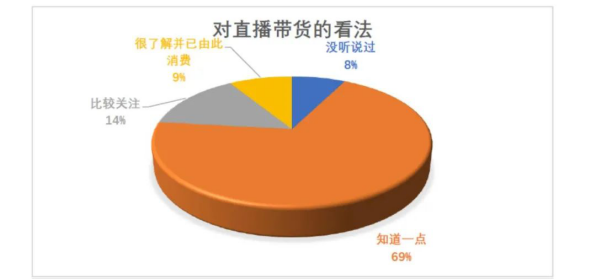

The model of online live streaming is attracting the attention of consumers. In this survey, 69.33% of consumers said they were aware of this shopping model, 14.4% of consumers said they were very concerned about it, and 8.8% of consumers said they had made purchases through online live broadcasts.

In the survey on the current problems in clothing design, production and sales, the most criticized by consumers are the high price of clothing and the lack of individuality and lack of distinctive positioning in clothing design. The proportions reached 43.91% and 41.96% respectively.

In terms of brand recognition, domestic brands are recognized by most consumers, with 71.64% of respondents expressing their recognition of domestic brands.Can.

As for the budget for purchasing clothing in the second half of the year, 37.6% of consumers said that the budget will be reduced, and 17.87% of consumers said that the budget will be significantly reduced. This proportion is different from previous years. Compared with the previous year, only 10.49% of consumers said their budget would increase.

Consumers tend to consume rationally during the epidemic

The impact of the COVID-19 epidemic on consumers’ income and consumption behavior , consumer psychology and other aspects have caused certain negative impacts. However, judging from the survey, the impact is not as big as expected, and everyone’s consumption behavior is relatively rational.

In terms of income, only 6.13% of the respondents believed that there would be a great negative impact, 43.38% of consumers said that the impact was small, and 28.36% of consumers said that there was no impact. When asked whether any consumers at home had lost their jobs due to the epidemic, only 17.24% of consumers said this was the case.

The epidemic has a certain impact on consumption. Among the respondents, 62.4% of consumers said that consumption has decreased, or even have no desire to consume at all, 35.82% of consumers said that consumption has not been affected; 1.78% of consumers said that consumption has increased.

As to whether there will be retaliatory consumption on clothing after the epidemic, only 12.44% of consumers said they would, and 77.78% of consumers clearly said they would not.

As for their views on the domestic economic situation after the epidemic, most consumers, accounting for 54.93%, said they were optimistic or very optimistic; only 19.82% of consumers said they were pessimistic or very pessimistic.

Through the data, it is not difficult to find that the consumption behavior of domestic consumers is becoming more and more rational. The price and style of clothing These are the two elements that consumers are most concerned about. More convenient consumption methods such as online shopping are increasingly favored by everyone, and the model of online live streaming will receive greater attention. However, there are still great differences in the consumption patterns and consumption needs of different classes of consumer groups.

In the second half of the year, it is expected that the demand in the domestic apparel market will still be in a relatively sluggish state, which will have a certain negative impact on the operations of textile and apparel companies. In this context, it is particularly important for textile and apparel companies to accurately grasp consumers’ consumer psychology and needs. </p