According to the price monitoring of SunSirs, the overall domestic polyester filament market has maintained a slight downward trend this week, among which polyester FDY and polyester POY began to rebound mid-week. .

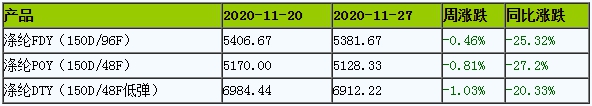

The average market price of polyester filament from November 20 to 27 (unit: yuan/ton)

week Initially driven by the raw material market, production and sales took off. On the 25th, the production and sales of polyester filament exceeded 300%. Downstream textile companies were more willing to buy bottoms. Some downstream factories replenished goods. Purchasing intensity was generally higher than in the previous period. The market trading atmosphere was hot. Factory inventory pressure has also eased.

However, as crude oil has fallen, the popularity of weaving has receded, and production and sales have followed suit. The current average production and sales of mainstream factories is around 60%. The overall inventory of the polyester market is concentrated at 23-36 days, of which POY inventory is around 6-13 days, FDY inventory is around 16-34 days, and DTY inventory is around 24-36 days.

In terms of price, the current price of polyester POY (150D/48F) in mainstream factories in Jiangsu and Zhejiang is 5050-5250 yuan/ton, polyester FDY (150D/96F) is quoted at 5150-5450 yuan/ton, and polyester DTY (150D/ 48F low bomb) quoted 6800-7000 yuan/ton.

Crude oil continued to rise this week, and cost support increased. As of November 25, the settlement price of the main international crude oil WTI contract was US$45.71/barrel, an increase of 26.38% from the beginning of the month, and the settlement price of the main BRENT contract was US$48.61/barrel, an increase of 26.84% from the beginning of the month. Hitting the highest level since March, on the one hand, the continuous good news about the new crown vaccine has boosted demand expectations; on the other hand, according to the news released by the market, OPEC+ is expected to further maintain the current ultra-large production cuts, which is good for supply expectations. PTA spot market prices also showed a rebound. As of November 27, the average market price was 3,343 yuan/ton, a weekly increase of 1.42%, and a year-on-year decrease of 30.90%.

Recent domestic PTA device maintenance status unit: 10,000 tons/year

PTA devices are gradually restarted and supply is boosted. Sichuan Energy Investment’s 1 million-ton PTA unit will restart on the evening of November 23; Shanghai Yadong Petrochemical’s 700,000-ton PTA unit plans to restart on the evening of November 27; Zhongtai Petrochemical’s 1.2 million-ton PTA unit is expected to restart at the end of this month, and the industry’s operating rate has increased to more than 91%. The restart of equipment accelerates the accumulation of inventory, and the negative effects of excess still restrain the growth of PTA.

Towards the end of November, the domestic textile terminal market continues to cool down, the traditional off-season textile enterprises’ operating rate has declined, and the comprehensive operating rate of Jiangsu and Zhejiang looms has been reduced to 86 %, the polyester industry’s high production and sales lack sustainability after all.

According to China Textile City, the downstream fabric trade has begun to see orders reduced and suspended. Curtain fabrics and home decoration fabrics with polyester filament as the main raw material on the market are still less than in previous sales seasons due to the number of customers entering the market. Some small and medium-sized business households are still relatively limited in placing orders from corresponding customers. However, the batch size of orders shipped by each operating store is still relatively limited. However, the overall market sales volume is still insufficient. It is expected that the traditional market transactions will fluctuate and shrink, and the overall market transactions will show a volatile and slightly downward trend.

Xia Ting, an analyst at SunSirs, believes that there is insufficient momentum for crude oil to continue to rise. PTA began to accelerate the accumulation of inventory at the end of November, and Fujian Baihong’s new production capacity is planned to be launched next month, which will intensify the pressure of oversupply. In addition, terminal textiles have entered the traditional off-season, with poor new orders in the market and a strong wait-and-see sentiment. It is expected that short-term polyester filament prices may stabilize and weaken. </p