Introduction: Polyester is a general term for polymers obtained by the condensation of polyols and polybasic acids. Mainly refers to polyethylene terephthalate (PET), but also traditionally includes linear thermoplastic resins such as polybutylene terephthalate (PBT) and polyarylate. It is a type of engineering plastics with excellent performance and wide range of uses. .

Polyester is a polymer compound, which is produced by polycondensation of terephthalic acid (PTA) and ethylene glycol (EG) to produce polyethylene terephthalate (PET). ), some of the PET is finally produced through underwater pelletizing. Fiber-grade polyester chips are used to make polyester short fibers and polyester filaments. They are raw materials for polyester fiber companies to process fibers and related products. As the largest output variety of chemical fibers, polyester occupies nearly 80% of the market share in the chemical fiber industry. Therefore, The market changes and development trends of polyester series are the focus of the chemical fiber industry. At the same time, polyester is also used in bottles, films, etc., and is widely used in the packaging industry, electronic appliances, medical and health, construction, automobiles and other fields. Among them, packaging is the largest non-fiber application market for polyester, and it is also the fastest growing field for PET. . It can be said that polyester chips are an important intermediate product connecting petrochemical products and products in multiple industries.

1. Polyester production capacity has grown steadily, bottle-grade PET has developed rapidly, and polyester accounts for the largest proportion

Polyester related product production capacity share chart from 2015 to 2020

Data source: Jin Lianchuang

In recent years, with the development of the national economy and increasing social demand, domestic polyester PET production has continued to grow. Polyester PET is the main raw material for the textile industry and beverage packaging industry. The rapid development of the textile industry and beverage industry is the main reason for the rapid growth of polyester production capacity. In order to meet the demand of domestic and foreign textile and apparel markets, the production scale of my country’s textile industry has continued to expand in recent years. From 2015 to 2020, the average annual growth rate of domestic polyester bottle flake production capacity was the highest, mainly due to the healthy development of domestic beverage demand in recent years. Followed by the growth rate of polyester filament, while the growth of polyester staple fiber, polyester chips and film is relatively slow. In terms of comprehensive production capacity, although domestic polyester production capacity tended to be saturated in 2015, with the deepening of the country’s supply-side reform, the growth rate of polyester production capacity has slowed down, and some backward production capacity has been cleared. However, in 2018, domestic polyester production capacity entered a new development period, with new production capacity being put into operation intensively, and the average annual growth rate of production capacity being as high as 11.2%. In 2019, domestic polyester production capacity returned to the slow development track, the industry re-emerged with overcapacity, new production capacity decreased significantly, and the average annual growth rate of production capacity dropped to 7.19%. In 2020, the start-up of new domestic polyester production capacity slowed down, with an average annual growth rate of 6.18%. As of 2020, the total polyester production capacity was approximately 63.975 million tons.

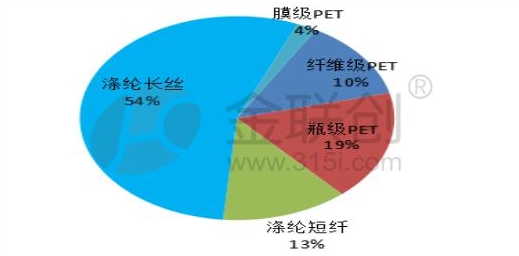

Polyester product production capacity share chart in 2020

Data source: Jin Lianchuang

Among domestic polyester products in 2020, polyester filament accounted for the highest production capacity at 54%, followed by polyester bottles The film is 18%. Polyester staple fiber accounts for 13%, polyester chip production capacity accounts for 11%, and diaphragm production capacity accounts for only 4%.

II. Future development forecast of the polyester industry

Future polyester production capacity comparison from 2020 to 2023 Picture

Data source: Jin Lianchuang

In the next few years, China’s polyester market will show a slow growth trend. It is expected that China’s polyester production capacity will grow at a rate of less than 5% from 2021 to 2023.

Among them, bottle-grade PET has a faster growth rate, around 10%; polyester growth has slowed down to around 5%. The growth rate of short fiber and fiber grades is around 2%.

Bottle-grade PET: The market supply will still maintain a steady growth trend. In 2021, China Resources Zhuhai’s 600,000-ton plant and Baosheng’s new 500,000-ton plant in Sichuan will be put into operation. From 2022 to 2023, the second phase of Wankai Chongqing’s 600,000-ton plant will be put into operation and a new 100,000-ton plant in Tunhe, Lanshan, Xinjiang will also be put into operation. will be put into operation. There will be more large-scale bottle flake factory projects in the future. Yisheng Petrochemical’s 2 million tons project, Pan Asia’s 1.2 million tons project, Sanfangxiang’s 3 million tons bottle flakes project, and Yizheng’s 500,000-ton new device are all actively planning In the future, the production capacity of leading bottle flake companies will continue to expand and their market share will become more concentrated.

Fiber-grade PET: In the next three years, it is expected that the supply side of my country’s fiber-grade PET market will still be in a state of oversupply. In the next three years, Tianlong New Materials’ 200,000-ton new equipment and three-dimensional chemical fiber’s 200,000-ton new equipment will be put into operation, and there are multiple new polyester equipments with side cutting capacity. In the future, the market share of fiber-grade PET will be more concentrated in those with refining and chemical integration. Among the leading companies in terms of capabilities, the melt straight mill device further squeezes the living space of the chip spinning device, and the long-term operation of fiber-grade PET downstream chip spinning plants maintains 50% to 60%. In recent years, chip spinning filament factories have abandoned conventional white yarn, both Began to devote itself to the production of differentiated filament yarns, such as colored yarns, cationic yarns, flame-retardant yarns, composite yarns, etc., while differentiated filament yarns are mainly used for foreign trade exports. The severe overseas epidemic and the slow economic recovery have inhibited future demand prospects. In the next few years, It is still difficult for fiber-grade PET to get out of the oversupply situation.

Polyester staple fiber: market��Production capacity will increase significantly. Although most of them are differentiated short fiber and are highly competitive, due to the good profits of short fiber in recent years and the high enthusiasm of factories to start operations, future supply pressure cannot be underestimated. As the research and development of the new coronavirus vaccine accelerates, some countries have developed and begun to promote the injection, which will be of great help to the recovery of the economy, and foreign trade orders will gradually return to normal. Downstream spinning mills still have more production capacity, and short fiber is still in a relatively healthy state among various polyester varieties.

Polyester filament yarn: From 2021 to 2023, the new production capacity of polyester filament yarn is expected to reach 10.71 million tons. The growth rate of production capacity tends to be flat. The investment of new production capacity still mainly comes from Leading enterprises. Among them, Xinfengming Group will add 3 million tons, Tongkun Group will add 2 million tons, Hengyi Group will add 1.3 million tons, and Hengli Group will add 2.3 million tons. Leading companies continue to release new production capacity, industry concentration will further increase, industrial chain supporting facilities will be more complete, and the supply of differentiated polyester filament will steadily increase. At the same time, the growth rate of downstream demand may slow down, and oversupply will still be a problem in the future. Big problem. </p