Recently, Jiangsu Taimusi Knitting Technology Co., Ltd., a vertically integrated clothing manufacturer that provides OEM processing services for well-known clothing brands such as Decathlon, Semir Clothing, Quiksilver, Kappa, Giordano, and Cotton Times, has (hereinafter referred to as “Taimushi”), it was recently disclosed that its application for a small-cap IPO has been accepted.

It is reported that Taimushi signed a tutoring agreement with the former tutoring institution GF Securities Co., Ltd. on December 12, 2019, and completed the tutoring filing the next day. Later, because GF Securities was suspended from sponsoring agency qualifications from July 20, 2020 to January 19, 2021, after negotiation, Taimus changed the coaching agency to Huatai United Securities.

In July 2020, Huatai United Securities reviewed and approved the coaching work of the former coaching agency. On August 18, the two parties re-signed the coaching agreement and completed the coaching filing on August 24. The counseling working group consists of six people including Li Wei, Li Zonggui, Wang Qinghong, Ding Lubin, Liu Changting, and Jiang Lei from the Investment Banking Department of Huatai United Securities. In addition, the practicing law firm participating in the counseling is Beijing Zhonglun Law Firm, and the accounting firm is Shun Lun Pan Accountants LLP (Special General Partnership).

After counseling, Huatai United Securities believes that Taimusi has initially met the basic conditions for entering the market, and submitted the “Huatai United Securities Co., Ltd. Regarding Jiangsu Taimusi” to the Jiangsu Securities Regulatory Bureau on November 3, 2020. “Summary Report on the Initial Public Offering and Listing Counseling Work of Mushi Knitting Technology Co., Ltd.” and applied for counseling acceptance.

Public information shows that Taimusi was established on August 26, 1992. The company is located at No. 666, Yishou Road, Renshou Road, Chengbei Street, Rugao City, and its legal representative is Lu Biao. The main business is the research and development, production and sales of knitted fabrics and knitted garments. The main products can be divided into sportswear, casual clothing and children’s clothing.

1. The composition of the company’s operating income is as shown in the following table:

During the reporting period, from 2017 to 2019 and the first half of 2020, the company’s main business income was 647.9889 million yuan, 751.8947 million yuan, 788.0598 million yuan and 295.9465 million yuan respectively, accounting for 99.53%, 99.62%, and 295.9465% of the operating income respectively. 99.58% and 98.86%, the company’s main business is outstanding.

During the reporting period, the company’s gross profit composition is as shown in the following table:

During the reporting period, From 2017 to 2019 and the first half of 2020, the company’s main business gross profit was 153.4881 million yuan, 176.9093 million yuan, 183.4249 million yuan and 70.2484 million yuan respectively, accounting for 98.71%, 98.85%, 98.87% and 96.66% of the company’s total gross profit respectively. %.

Among them, the gross profits of knitted garments were 143 million yuan, 171 million yuan, 177 million yuan and 69.0099 million yuan respectively, accounting for 91.63%, 95.77% and 69.77% of the company’s total gross profits respectively. 95.21% and 94.96%, knitted clothing is the main source of the company’s gross profit.

During the reporting period, the company’s operating income composition is as follows:

The company’s main business income is mainly Sales revenue from knitted clothing and knitted fabrics, and other business revenue mainly include sales revenue from leftover materials, waste materials, etc. During the reporting period, main business income accounted for approximately 99% of operating income, and other business income accounted for a lower proportion.

2. Analysis of product structure of main business income

During the reporting period, the company’s main business The revenue breakdown by product is as follows:

During the reporting period, from 2017 to 2019 and the first half of 2020, the company’s main business income mainly came from knitted clothing. Sales revenue accounted for 89.54%, 91.92%, 92.54% and 95.99% of the main business revenue respectively. Knitted clothing includes sportswear, casual clothing and children’s clothing.

Among them, the sales of sportswear and children’s clothing, which are relatively popular in the market, are showing an overall upward trend. The total sales revenue of sportswear and children’s clothing account for the proportion of main business revenue respectively. 66.39%, 78.17%, 80.36% and 79.53%; the proportion of casual clothing sales has declined overall, and the proportion of casual clothing sales revenue in the main business revenue is 23.15%, 13.75%, 12.18% and 16.46% respectively.

In addition, from 2017 to 2019 and the first half of 2020, the company’s main business income was mainly domestic sales, and the proportion of domestic sales income in the main business income was 69.04%, 63.55%, and 63.55% respectively. 61.35% and 67.18%. The proportion of export sales revenue in the main business revenue was 30.96%, 36.45%, 38.65% and 32.82% respectively. The company’s export sales are mainly sold to Europe.

3. Analysis of main business income changes

During the reporting period, the company’s main business income was 648 million yuan, 752 million yuan, 788 million yuan and 296 million yuan respectively. In 2018 and 2019, the company’s main business income increased by 16.04% and 4.81% respectively, showing a sustained growth trend. This was mainly due to the continuous improvement of residents’ consumption levels and the continuous upgrading of consumption concepts, and the sportswear and children’s clothing market maintained rapid growth. Under the strategy, the company’s core competitive advantages such as vertical integration advantages, process and technology advantages, management and cultural advantages have been further enhanced, the business structure has been further optimized, and the scale of cooperation with major customers has increased. In the first half of 2020, affected by the epidemic, the company’s main business income declined.

During the reporting period, the changes in revenue from the company’s major products such as sportswear, casual wear and children’s clothing are as follows:

1) Sportswear

During the reporting period, the company’s sportswear sales revenue were 329.9013 million yuan, 422.1192 million yuan, and 483.7836 million yuan respectively. and 175.7865 million yuan. The company’s sales volume and average sales price changes of sportswear are analyzed as follows:

The company’s sportswear customers are mainly Decathlon, Quiksilver and Kappa.

In 2018, the company’s sportswear sales revenue increased by 92.2179 million yuan compared with the previous year, mainly due to the deepening of the company’s cooperation with customers such as Decathlon. On the one hand, the company’s sportswear sales volume An increase of 1.0726 million pieces has an impact on the increase in main business income of 29.1723 million yuan; on the other hand, the company’s sportswear product structure has been optimized, and the sales proportion of high-priced products such as women’s fitness sportswear and outdoor sportswear has increased, resulting in an average sales of sportswear The unit price increased by 4.77 yuan per piece, and the impact on the increase in main business income was 63.0456 million yuan.

In 2019, the company’s sportswear sales revenue increased by 61.6644 million yuan compared with the previous year. The main reasons are: on the one hand, the company’s sportswear sales increased by 592,100 pieces, which has a negative impact on the main business. The impact of the increase in revenue was 18.9318 million yuan; on the other hand, the company’s sales proportion of high-priced products such as outdoor sportswear and mountain sportswear increased, causing the average sales unit price of sportswear to increase by 3.10 yuan/piece, and the impact on the increase in main business income was 42.7325 million yuan.

2) Casual clothing

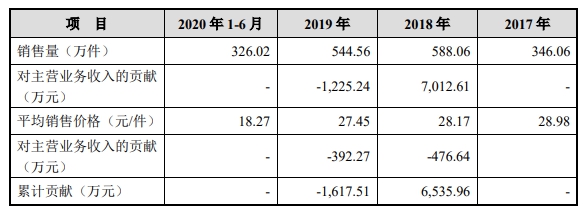

During the reporting period, the company’s sales revenue of casual clothing was 15,001.93 respectively. Ten thousand yuan, 103.3945 million yuan, 95.9835 million yuan and 48.715 million yuan. The company’s casual clothing sales volume and average sales price changes and other factors are analyzed as follows:

The company’s casual clothing customers are mainly Semir Clothing, Liangzhi Clothing, and Quan Cotton Times, Ou Shili, etc. In 2018, the company’s casual clothing sales revenue decreased by 46.6248 million yuan compared with the previous year, mainly due to a decrease in casual clothing sales volume of 1.8447 million pieces. Because the company’s existing production capacity is relatively limited, and combined with downstream market demand, the company has appropriately reduced the production and sales of casual clothing and increased the production of sportswear and children’s clothing. For example, in 2018, the company’s sales of Semir clothing and casual clothing decreased by 901,300 pieces. , sales volume to Oushili decreased by 552,900 pieces.

In 2019, the sales volume and sales unit price of the company’s casual clothing dropped slightly, and sales revenue decreased by 7.411 million yuan.

3) Children’s clothing

During the reporting period, from 2017 to 2019 and 2020 The company’s children’s clothing sales revenue in the first half of the year were 100.282 million yuan, 165.6416 million yuan, 149.4665 million yuan and 59.5689 million yuan respectively.

The company’s children’s clothing sales volume and average sales price changes and other factors are analyzed as follows:

Company Children’s clothing customers are mainly Semir Clothing, Cotton Times, OKAIDI, etc. In 2018, the company’s sales revenue from children’s clothing increased by 65.3596 million yuan compared with the previous year, mainly due to the increase in the sales volume of children’s clothing. As Semir Clothing’s children’s clothing brand Balabala continues to strengthen its market leading position, the company has strengthened the development of children’s clothing products for it, and its children’s clothing sales increased by 2.0197 million pieces. In 2019, the sales volume and unit sales price of the company’s children’s clothing sales decreased slightly, and sales revenue decreased by 16.1751 million yuan. </p