1 Crude oil plummeted, PTA fell to the limit, and polyester was brought back to its original shape

On Thursday, affected by Powell’s dovish remarks in the early morning, U.S. bond yields jumped, of which the U.S. 10 The yield on 1-year government bonds hit a maximum of 1.75%, continuing to hit a new high since January last year. The U.S. and Burundi oil prices accelerated their declines after hearing the news, with the largest decline reaching 9%. Analysts pointed out that the strength of the U.S. dollar, falling stock markets, weak demand in Asia, and Mexico’s remarks about increasing production may put pressure on crude oil.

In the end, the two oil prices closed down more than 7%, with WTI crude oil experiencing the largest single-day decline since September last year. Crude oil and chemical products in the domestic market fell sharply on Friday, with PTA futures almost falling to the limit. Polyester staple fiber fell 2.91% to close at 7,014 yuan/ton. The price returned to the level on February 9, thus erasing all the gains since the Spring Festival. It has retreated 18.23% from the highest point of 8,578 yuan/ton on February 26. .

The spot market also took a sharp turn. On March 19, the price of polyester staple fiber was quoted at 7,050 yuan/ton, a drop of 950 yuan/ton from the highest point, but it was still 6,800 yuan/ton lower than before the holiday. The price still has some room, and the possibility of falling to the previous low in the later period cannot be ruled out.

▲Short fiber futures trend chart from January 28 to March 19

2 Seeing He stood up and saw his building collapse

As the U.S. dollar index rose, domestic and foreign futures positions shrank significantly, the downstream textile industry was tepid, new orders were insufficiently followed up, and cotton sales The temperature drops significantly.

According to data from the National Cotton Market Monitoring System, in the two weeks of March 1-5 and March 8-12, 2021, cotton processing enterprises across the country sold a total of 190,000 new cotton tons, 170,000 tons, a decrease of 30%-40% from the previous week and an increase of 10%-30% year-on-year. Between wait-and-see and hesitation, the price of some yarns has been reduced by nearly a thousand yuan per ton, and the price of cotton has fallen rapidly.

On March 19, the main cotton futures fell 2.68% to close at 15,260 yuan/ton, down 10.6% from the previous high, and have basically returned to the price before the market started in early February. The integer mark of 16,000 yuan/ton was previously regarded as a strong support level, but now it has become a resistance line.

According to feedback from some cotton textile factories in Hubei, Jiangsu and Zhejiang and other places, with the continuous downward breakthrough of Zheng cotton in early and mid-March, and the continuous downward breakthrough of Zheng cotton and Guangdong, Jiangsu and Zhejiang, etc. In the textile market, the quotations of domestic yarn and imported cotton have bottomed out by 500-1,000 yuan/ton. In addition, it is more difficult for clothing and foreign trade companies to receive new orders due to the sharp increase in raw materials, RMB fluctuations and other reasons. Weaving factories, fabrics and textile Inquiries and purchases of cotton yarn, polyester-cotton yarn, etc. by clothing companies have slowed down significantly compared with January and February.

A middleman in Shaoxing Textile City, Zhejiang Province said that in the past week or so, unlike in February where quotations were frequently raised and stocks were held for sale, cotton spinning mills in Henan, Shandong, Jiangsu and other places have They have actively contacted traders and weaving mills, and once there is a real order, the profit margin of the spinning mill will be relatively large. On the one hand, based on the current cotton spot price, the profit of the spinning mill is still relatively high (if there are 2-3 months of raw material inventory, The yarn mills have basically achieved the goal of “not opening for three years, but opening for three years”), and have greater confidence in preferential treatment; on the other hand, textile enterprises are worried that gauze will gradually accumulate stockpiles, which will not only occupy a large amount of funds, but also once the external environment changes and the epidemic returns, Uncertain factors such as the central bank’s monetary policy change or the emergence of uncertainties such as yarn mills competing to ship goods and withdraw funds have caused a stampede.

3 The fever of raw materials has subsided, the epidemic has recurred, and Sino-US relations have become tense again, “Golden Three” may leave sadly

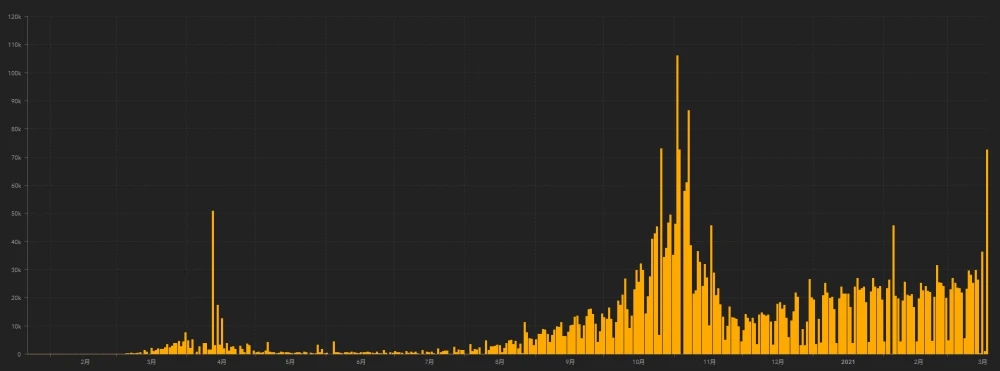

▲Newly confirmed cases in Europe from January 2020 to March 2021

Many European countries have recently entered the third wave of the epidemic. French Prime Minister Jean Castet announced on Thursday (18th) that the French capital Paris and several other regions will undergo a month-long lockdown starting at midnight on Friday in response to the surge in new crown cases.

In addition to France, European countries such as Germany, Italy, Hungary, Poland, and the Czech Republic have also entered a new round of blockade. Italy has classified more than half of its regions, including Rome, as “red zones” and implemented “city closures.” The German Disease Control and Prevention Agency stated that the country is in the early stages of the third wave of the epidemic.

Morgan Stanley believes that the resurgence of the epidemic in Europe in the summer may delay the region’s economic restart process. For the textile and apparel industry, terminal consumer demand is bound to be affected again.

On March 18, local time, Yang Jiechi, member of the Political Bureau of the CPC Central Committee and Director of the Office of the Central Foreign Affairs Commission, and State Councilor and Foreign Minister Wang Yi held a meeting with U.S. Secretary of State Antony Blinken and Assistant to the President for National Security Affairs Sullivan in Anchorage. U.S. high-level strategic dialogue.

Yang Jiechi said that in the past two days, he and State Councilor and Foreign Minister Wang Yi had long-term strategic communication with Secretary of State Blinken and Assistant Sullivan to discuss their respective domestic and foreign policies and bilateral relations. Had a candid and constructive exchange. This dialogue is beneficial and conducive to enhancing mutual understanding. The two sides still have important differences on some issues.

In the past few years, due to the unreasonable suppression of China’s legitimate rights and interests, Sino-US relations have encountered unprecedented serious difficulties. Information revealed from this meetingIt seems that there are still many issues between China and the United States that require dialogue and negotiation, and the Biden administration will certainly not lift existing sanctions against China.

The turbulent international situation has undoubtedly made it “even more difficult” for textile companies to receive orders. The person in charge of a foreign trade company said: “The impact of Sino-US relations on us is subtle. Yes, the impact of this year’s epidemic has left many companies without orders, but Sino-US relations cannot be ignored. Once Sino-US relations become tense, many customers will become more hesitant to place orders.”

In the face of factors such as macro-financial inflation, repeated epidemics, changes in industrial supply and demand, and Sino-US relations, factors that restrict the textile market in the short term are increasing, and it will take time and space to further release. In this context, the “Golden Three” peak season may sadly pass away.

Since last week, shipments in the cotton yarn market have slowed down significantly. However, since most textile companies still have orders in hand, and there are many orders for April-May, most textile companies are mainly waiting and watching, and the quotations remain stable, while some higher quotations are lowered.

On the other hand, if the yarn price adjusts downwards by a large margin, many problems will also be encountered. First, many textile companies have just raised the ex-factory price of cotton yarn one after another from late February to early March, and then lowered it significantly in just a few days. It may be difficult for customers to accept it, and repeated communication and negotiation are required;

Second, if the yarn price is reduced by more than 500 yuan/ton, it will be difficult to execute orders received after the Spring Festival, and the probability of default by buyers such as downstream fabric factories, clothing companies, and foreign trade companies will increase significantly. A cotton mill in Wuhan, Hubei Province said that due to the low number of orders after mid-April and the continuous slight rebound in gauze inventory; coupled with the difficulty in improving Sino-US relations in the short term and the resurgence of the new coronavirus variant in Europe, many places have restarted blockades. Therefore, there are no short-term plans to expand the replenishment of raw materials such as cotton and polyester staple fiber, and the next round of cotton procurement is expected to be postponed to at least mid-April. </p