Introduction: In the blink of an eye, it has reached the end of the third quarter. The PTA market has been fluctuating recently. The spot price of PTA at the end of August fell 11.31% year-on-year. The “Golden Nine and Silver Ten” peak season is about to usher in. Can PTA start an upward trend? , then follow the editor to take a look at the fundamentals of PTA supply and demand:

Figure 1 Brent and PTA price correlation chart

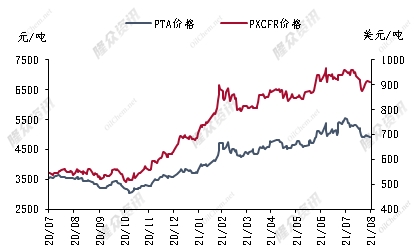

Figure 2 PX and PTA price correlation chart

Cost support and external factors complement each other

Recently, Hurricane Ida hit the U.S. Gulf of Mexico, causing supply shortages It contracted temporarily, but after it made landfall, it gradually attenuated and was downgraded to a tropical storm. International oil prices rose slightly. At the same time, the market is also paying attention to the output policy of OPEC and its allies to reduce production. According to news released on the OPEC website, the 19th Ministerial Meeting of OPEC and non-OPEC (OPEC+) will be held via video on September 1, 2021. Stay tuned then. Crude oil’s support for PTA is still strong, but its impact on PTA has decreased sharply compared with the first half of the year. Looking at the situation of PX, the current operating rate of PX remains at 78.42%, the supply of goods is still relatively tight, and the price is relatively stable. The PX cracking spread has been in a state of continuous repair since the beginning of March. The current PX cracking spread has been maintained at around US$250/ton. As long as crude oil has not changed significantly, PX’s short-term cost support for PTA is acceptable.

Figure 3 PTA supply and demand balance forecast in 2021

The supply and demand pattern is weakening, and internal factors play a key role

The supply and demand pattern is the dominant factor in the current PTA. Let’s first look at the PTA supply side. Starting from March, major PTA manufacturers have taken turns to conduct intensive maintenance, and the supply of major manufacturers has been reduced. The superimposed polyester load has remained high, causing the market to continue to show a destocking rhythm, which has restricted the continued decline of PTA prices. possible. However, starting from August, although the overall destocking pattern was still in place during the month, with the gradual restart of new materials, Sanfangxiang, and Honggang petrochemical plants in late August, the PTA supply and demand accumulation pattern in September is gradually emerging. However, considering that the processing fee of PTA has shown obvious signs of correction, from 861 yuan/ton at the beginning of August to 466 yuan/ton at the end of August, if the cost side of crude oil and PX is still strong, but due to the weakening supply and demand, the spot price of PTA will rise accordingly. If it is insufficient, the PTA processing interval will show a compression trend as a whole. Secondly, the peak season of Gold, Nine and Silver is approaching, but it seems that what the market is ushering in is not the high mood of rising orders and product prices during the peak season. Instead, it can only be described as light and calm. The downstream terminal textile market as a whole is in a relatively sluggish stage. The downstream centralized procurement of raw materials and preparations for stocking can only reveal a glimmer of hope from the frequent promotions of polyester and the reduction of production and burden. However, too frequent operations on the polyester end have also weakened the terminal market and buying sentiment. Therefore, the PTA market’s Gold, Nine and Silver Ten may no longer be viewed as seasonal off-peak and peak seasons, and the market should treat them rationally.

Taken together, PTA currently lacks stimulating factors to boost, and the increase in supply and demand is the main negative factor. Looking forward to the market outlook, when the cost-side market has not yet seen a sharp decline, PTA will not be in a deep downward trend for the time being, and range-bound fluctuations will be the main tone. Specifically, we still need to pay attention to the recovery of terminal orders for the Golden Nine and Silver Ten and the polyester inventory situation. Proceed with caution. </p