“If there are no more orders, we will close the factory for a holiday in May,” said Manager Wang, the person in charge of a weaving company.

The company run by Manager Wang has nearly 200 looms, with a daily gray cloth production capacity of up to 100,000 meters. The current gray cloth inventory has reached nearly 200 meters. Thousands of meters. During the Qingming Festival, because there were almost no new orders, his factory gave workers a week-long holiday. After the holiday, there was still no improvement in orders, so the original second shift was changed to a third shift, and the machines stopped for a third. one.

And this is not a example. Beginning in March, as the global epidemic began to spread, the number of orders in the market shrank sharply, and the operating rate of looms began to decline instead of rising. According to data monitoring from China Silk City Network, as of April 17, the operating rate of looms in Jiangsu and Zhejiang has dropped to 67%. At this time last year, the operating rate was as high as about 90%.

In contrast, there is a huge inventory of gray fabrics. According to China Silkdu.com data monitoring shows that as of April 17, the average inventory of weaving companies in Jiangsu and Zhejiang has been as high as 42.5 days, almost the same as last year’s highest point.

I want to sell goods, but no one “takes the order”

When inventories were at their highest last year, weaving companies chose to “dispose of goods and dump goods” under tremendous pressure. Many traders in the market chose to “take over” orders at low prices. Although weaving companies suffered losses Some but at last a lot of inventory was removed to recover funds, and traders obtained low-priced cloth and made profits. This result is acceptable to both parties.

But this year’s situation is completely different. Due to the impact of the epidemic, there is almost no demand from terminals, and weaving companies almost accumulate as much inventory as they produce. Because the market outlook is unclear, traders no longer dare to “take orders” rashly, and weaving companies may not be able to sell goods even if they want to reduce prices. Under such circumstances, it is almost certain that gray fabric inventories will continue to increase.

It’s not that I don’t want to stop! But it can’t stop!

But even under such circumstances, most weaving companies are still operating. Do they not want to stop production? No, they just couldn’t stop.

On the one hand, it is the problem of workers. In recent years, weaving companies have spent more and more on worker wages every year, but it is becoming increasingly difficult to recruit skilled workers in the market. Some hard-working and skilled workers are valuable assets for enterprises. Once production is suspended, it is not easy for enterprises to find suitable workers in a short time if they want to resume work in the future.

Especially in some factories that were established earlier, some workers have been working in the factory for more than ten years. It can be said that It has become an integral part of the factory. To stop production under such circumstances, you have to make not only an economic choice, but also an emotional choice.

Another On the one hand, there is the issue of loans. The more difficult the business is, the more important cash flow is to the company. The editor once watched a Japanese drama “Naoki Hansawa”, and the line “Banks give out umbrellas on sunny days and take away umbrellas on rainy days” is still fresh in my memory. In the process of production and operation, weaving companies will more or less have some loans. Now the market is not good and the market confidence is insufficient. If the bank requires early repayment due to production suspension, the company will be pushed into an even more difficult situation.

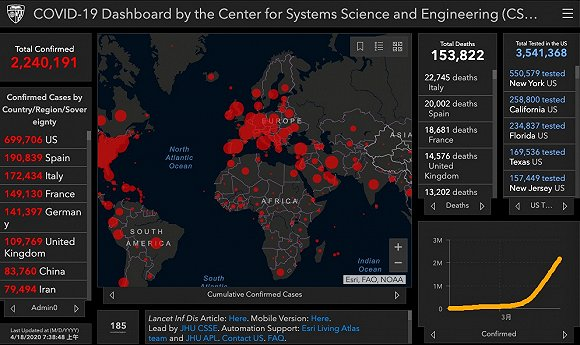

Today, the global epidemic is still developing at a high speed and is not under control at all. According to real-time statistics from Johns Hopkins University in the United States, as of 7:38 on the 18th, Beijing time, there were a total of 2,240,191 confirmed cases of new coronary pneumonia in the world, and a total of 153,822 deaths.

With major European and American countries suffering from the epidemic, in the short term, the foreign trade market is almost impossible to count on. Some weaving bosses pessimistically believe that the impact of the epidemic may last until the second half of next year, by which time the foreign trade market will be able to recover.

The situation in the domestic trade market is quite different. Although cloth bosses have generally reported that domestic trade orders are as insufficient as foreign trade in recent times, the domestic epidemic has beenBasic control, as long as we can strictly prevent imported cases, I believe the recovery speed of the domestic trade market will be greatly accelerated.

In addition, governments in many places have recently issued consumer coupons to stimulate consumption, which has achieved good results. In the context of overall overcapacity in China’s manufacturing industry , government departments may issue more plans to stimulate consumption in the future to further boost domestic demand. Perhaps then, the market will truly recover.

</p