In mid-to-late June, the off-season atmosphere of the market has begun to deepen. Orders from weaving manufacturers are still missing, inventories continue to accumulate, and the delivery speed is even worse than in the previous period. The market situation Start walking down the fast path.

For polyester filament, downstream demand has been difficult to effectively support its market. In the recent stage, production and sales have exceeded 100, relying solely on higher crude oil prices to drive up PTA and ethylene glycol prices, thereby driving The price of polyester filament has recovered, stimulating the purchasing enthusiasm of weaving manufacturers. As crude oil prices fell slightly, polyester production and sales showed obvious signs of decline, and the prices of polyester products also fell significantly.

Under the trend that the market is not optimistic about the polyester market, some polyester units are still expected to be put into production in June, with a total production capacity of about 1.55 million tons. Among them, Shenghong’s 250,000-ton polyester filament device is expected to be put into operation in mid-to-early June, and Hengli Hengke’s 200,000-ton polyester filament device is expected to be put into operation in late June.

In fact, judging from the market situation in the first half of this year, the recommissioning of the polyester plant will undoubtedly make things worse. , the polyester market itself is weak, and the polyester raw material end and downstream weaving end have no obvious benefits.

Polyester stocks are high

Since this year, affected by the new crown epidemic, global demand for textile and apparel products has dropped sharply. This greatly reduces the delivery speed of polyester products. Various products in the polyester market have begun to accumulate inventory. Although sometimes regular replenishment or news influence stimulates weaving manufacturers to replenish stock, and a small wave of inventory will be lost. However, in general, the current inventory of some products in the polyester market is still relatively high. s position.

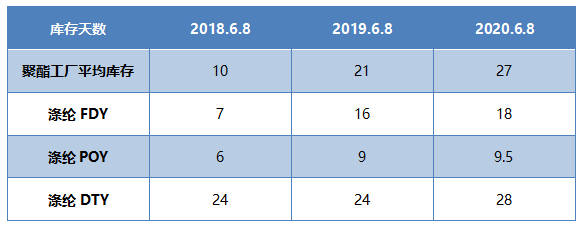

As of June 8, the average inventory of polyester factories was about 27 days, compared with about 21 days in the same period last year, and only about 10 days in the same period in 2018. Broken down, the current polyester FDY inventory is about 18 days, last year was about 16 days, and in 2018 it was about 7 days; the current polyester POY inventory is about 9.5 days, last year was about 9 days, and in 2018 it was about 6 days; Polyester DTY has not changed much. It is currently around 28 days. In the same period in the past two years, it remained around 24 days.

As can be seen from the table, polyester FDY has the biggest change in inventory. Since it is the most widely used, it has naturally become the most difficult product to sell under this year’s market conditions; POY has gone to The inventory effect is significant, and the inventory days are close to the same period in previous years; while DTY is as always at the highest inventory level among the three products, with little change.

PTA and ethylene glycol stocks are at high levels

In recent times, we have been saying that for the polyester yarn market, it is currently at a In the situation of hot weather and cold weather, the rise in polyester prices and the explosion in production and sales are mostly dependent on the strong rebound of polyester raw materials PTA and ethylene glycol. PTA and ethylene glycol have recently begun to pick up due to the rise in the crude oil market, with prices rising significantly compared with April.

However, from the overall fundamentals of PTA and ethylene glycol, there is still a large bias in the later period. Weak expectations due to high inventory! As of June 5, the social inventory of PTA was around 2.29 million tons, and the social inventory of ethylene glycol was around 1.334 million tons, once again setting a new high for the year.

In terms of PTA, the PTA equipment of many manufacturing companies has been shut down recently. As of the 5th, the average operating rate of PTA was around 77.6%, which was lower than the previous period. PTA was able to absorb part of the inventory, but due to the serious accumulation of inventory in the early stage, the trend of high inventory will continue in the short term.

In terms of ethylene glycol, excluding the inventory pressure at the import end, the overall operating rate of domestic ethylene glycol has continued to be low recently, around 51.9%. However, it is difficult to consume so much due to demand from the polyester end. Inventory, resulting in ethylene glycol has been accumulating inventory recently even with low operating rate. Some coal-to-ethylene glycol plants have announced plans to restart, most of which will be in mid-to-late June. The increase in domestic supply is expected to be felt in July, which will undoubtedly make the current high inventory pressure even worse.

Weaving manufacturer inventory High position

Since the beginning of this year, the vast majority of weaving manufacturers have been in a state of extremely uneven production and sales. Demand has recovered slowly and insufficient order follow-up has caused many weaving manufacturers to close their doors in April. Begin to reduce burden and production. Entering May, the order situation has only partially improved, and the overall market trend is still unclear.��, conventional products are unsaleable, there is no bright spot in the market to support them, and it is difficult to ship products, causing weaving manufacturers to continue to enter an inventory accumulation cycle.

According to the sample companies tested by China Silk City Network, the current gray fabric inventory in Jiangsu and Zhejiang is about 43 days, the same period last year was about 41 days, and the same period in 2018 was only about 25 days. Belongs to normal inventory status. Judging from the current market conditions, domestic trade competition is fierce and foreign trade recovery is difficult. Weaving manufacturers will continue to accumulate inventory. If there is no substantial change in the market outlook, manufacturers’ operating rates may further decline.

Postscript

At present, the inventory of polyester yarn itself is at a high level, and the inventory of PTA, ethylene glycol and woven gray fabrics continues to hit new highs in the new year. The upstream and downstream inventories are both high. Naturally, it is difficult to form an effective cost support and backing for polyester yarn. Polyester yarn prices The sustained rise is still difficult.

In the absence of favorable conditions for all parties, the resumption of production of the polyester plant will undoubtedly be a heavier blow to polyester products, and may accelerate the decline of polyester product prices. Polyester filament is no exception.

</p