2020 is destined to be an extraordinary year. The raging epidemic has put China and the global economic development under tremendous pressure, and at the same time caused heavy losses to China’s textile and apparel industry.

As for the performance of the capital market, China Galaxy Securities believes that in 2020, affected by the epidemic, the textile manufacturing sector benefited from a substantial increase in exports of anti-epidemic products such as masks and protective clothing, and its performance was relatively impressive; Due to the gradual easing of the domestic epidemic and the impact of the cold winter, the apparel and home textiles sector is expected to achieve results in the fourth quarter of 2020 and the first quarter of 2021.

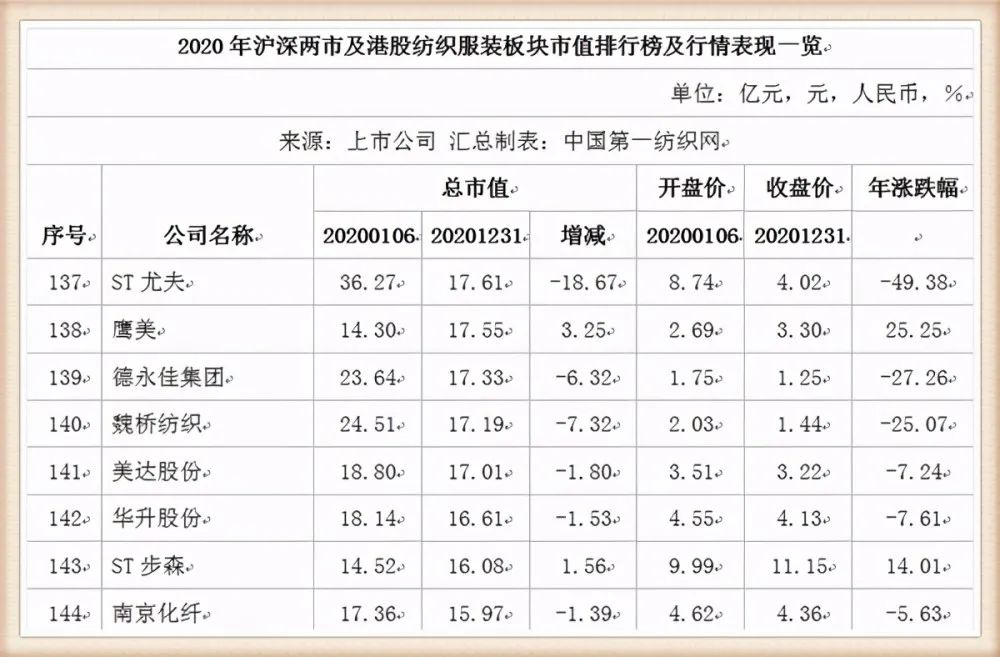

The data compiled by the editor on the market value rankings of the Shanghai and Shenzhen stock markets and the Hong Kong stock market textile and apparel sector in 2020 as of the close of trading on December 31, 2020 show that the top ten in market value are Anta Sports and Hengli. Petrochemical, Shenzhou International, Rongsheng Petrochemical, Li Ning, Prada, Winner Medical, Hengyi Petrochemical, Huafeng Spandex, Guangwei Composite Materials; from the market value rankings of the above companies, it can be seen that among the Chinese textile and apparel companies, the market value is currently the highest It is Anta Sports, followed by Hengli Petrochemical, and the third place is Shenzhou International.

Industry insiders said that despite the impact of the epidemic in 2020, textile and clothing The sector was greatly affected, and the overall performance of the A-share textile and apparel sector was mediocre. However, driven by economic recovery and consumption recovery, there is a high degree of certainty that the fundamentals of relevant leading companies will improve. The overall sales growth rate from the fourth quarter of this year to the first half of next year is expected to further increase year-on-year, and the elasticity of net profits will also be greater.

China Galaxy Securities analyst Lin Xiangyi pointed out that first of all, in terms of supply in the textile manufacturing industry, from February to early March this year, exports were mainly affected by the delay in resumption of work, from January to November The total exports of textiles and clothing were approximately US$265.218 billion, a year-on-year increase of 7.43%. Among them, textile yarns, fabrics and products increased by 20.96% year-on-year in November. This was mainly due to the fact that the domestic epidemic has been effectively controlled since March, and domestic textile enterprises have basically resumed work and the Spring Festival. Former export orders have been gradually completed and exported, and the growth in exports of anti-epidemic supplies (masks, etc.) has driven high growth in textile exports. However, as the overseas epidemic gradually comes to an end, foreign consumer demand for clothing is weak, and international brands have closed more offline stores. Clothing and clothing accessories increased by 3.60% year-on-year; on the demand side, as the new crown vaccination is on the schedule, Europe and the United States The possibility and severity of another outbreak are expected to weaken. Coupled with the cold winter and the late Spring Festival, the peak sales season of autumn and winter clothing with higher unit prices is expected to extend to February 2021.

Secondly, in terms of clothing demand, from the demand side: mortgage loans, medical care, and education in first- and second-tier cities squeeze disposable income, causing the population to return to lower-tier cities. At the same time, the returning population brings strong purchasing power and new consumption concepts, showing a “qualitative” and “quantitative” consumption upgrade; policy dividends and profound changes in population structure differentiate the consumption structure; from the supply side: personalization and differentiation With the rise of globalized consumption, original brands and new categories of goods (such as smart home appliances) will open up a new blue ocean in the consumer market; first- and second-tier shopping malls provide blood for experiential consumption; e-commerce has fully penetrated into lower-tier cities, and Alibaba’s C2M strategy (super factory Plan, Ten Billion Production Area Plan, Taobao Special Edition APP) is another major measure to pursue further expansion of the sinking market, that is, the second main line of “linking industrial belts, shortening the supply chain to condense cost performance”; affected by the epidemic, Live e-commerce replaces some traditional offline consumption scenarios, and can focus on KOL monetization service platforms and product supply chain service platforms.

Lin Xiangyi said frankly that although the scale of various sub-fields in the textile and apparel industry is continuing to grow, the growth rate has slowed down, but the children’s clothing and sportswear industries will be on a high-prosperity track in the future. Specifically, domestic children’s clothing is still in the growth stage. With the stimulation of the second-child policy, the children’s clothing industry lacks a true absolute leader, resulting in rapid overall industry growth. Benefiting from the increasing domestic disposable income, the demand for sports and leisure continues. Increase, sportswear companies have been in a high-speed growth channel since 2014. Compared with the more mature consumer market in the United States, sportswear has the fastest growth rate, but the growth rate is still lower than that in China. Therefore, it is recommended that in the future we focus on the opportunities for domestic children’s clothing companies to reorganize, merge, and acquire to increase their scale and the sportswear industry to recover.

However, according to Sun Haiyang, a researcher at Tianfeng Securities, the textile and apparel industry chain has entered a comprehensive recovery since the end of the third quarter of 2020 and will continue until 2021. This is mainly due to several Factors in several aspects: First, as the domestic epidemic situation improves, terminal sales of downstream brands have begun to fully recover; at the same time, due to the cold winter in 2020 and the postponement of the Spring Festival in 2021 compared to the same period last year, the sales period of winter clothing has been lengthened; due to the brand The sales of high-end winter clothing products accounted for a large proportion of the whole year, so the performance of the downstream brand end is expected to accelerate; second, the upstream manufacturing end is due to the transfer of overseas orders.As orders from end customers resume, performance will continue to recover.

Sun Haiyang said frankly that the 2020 epidemic has brought a new industry change to the entire textile and apparel sector. The market share of high-quality enterprises will further increase; with the development of the industry, excellent domestic textile and garment enterprises will gradually emerge, which will present the following characteristics in the future: first, product is king, and the market competitiveness of the product itself will continue to be improved; second, attention will be paid to brand construction, and continue to improve the brand tone and brand image; the third is to continue to carry out refined management and pay attention to the quality of operations; the fourth is to strengthen digital construction, data-driven every link of the industrial chain, and improve overall operational efficiency.

</p