Due to the public health incident that raged from the beginning of the year to the end of the year, all walks of life have suffered huge challenges. 2020 is an extremely unusual year. Affected by this, the development of the ethylene glycol industry and its price trend in 2020 are also very different from previous years, and are under great pressure.

1. Ethylene glycol price review

In 2020, the center of gravity of ethylene glycol prices shifted significantly, reaching the lowest point at the end of March, with the market price below 3,000 yuan/ton. Since then, as domestic production has gradually recovered, prices have fluctuated upwards amid twists and turns, breaking through 4,000 yuan/ton at the end of the year, reaching the high point since the beginning of the year.

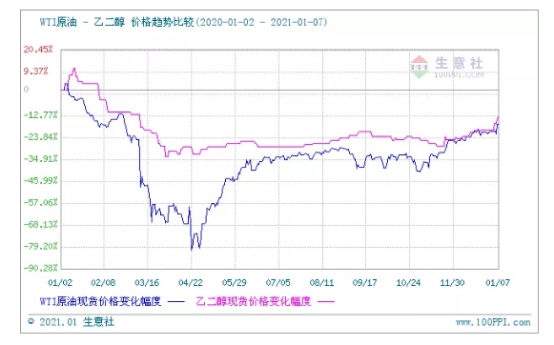

As can be seen from the figure, the market price of ethylene glycol in 2020 clearly shows two different stages.

In the first phase from January to March, due to the sharp decline in crude oil prices and collapse of costs, at the same time as the domestic public health incident developed violently and supply and demand weakened, prices A sharp decline.

Before the Spring Festival, due to rising oil prices, the inventory of ethylene glycol in the main port reached a low in recent years, and the price of ethylene glycol was once close to 5,500 yuan/ton. However, the public health incident broke out quickly shortly after, affecting both domestic and foreign countries. This resulted in delays in the resumption of work of downstream polyester and terminal weaving factories, impeded import and export, and a significant reduction in demand. At the same time, the start-up of new domestic units has brought about an increase in supply. For example, the 1.8 million tons/year units of Zhejiang Petrochemical and the 750,000 tons/year units of Hengli Petrochemical have been put into operation, which has greatly increased the supply of ethylene glycol. To make matters worse, crude oil prices have plummeted. Under the superposition of many unfavorable factors, the market price of ethylene glycol in East China exceeded the lower limit of 3,000 yuan/ton at the end of March.

The second phase begins in April, with ethylene glycol prices gradually rising.

Due to the low price of crude oil, the losses of coal-making equipment have intensified. Domestic companies have begun to stop production and reduce production, and supply pressure has been eased. However, due to the poor sales of foreign ethylene glycol this year due to the impact of terminals, a large amount of imported goods poured into the country. According to statistics, my country’s ethylene glycol import volume in the second and third quarters was significantly higher than in previous years. Although import volume declined in the fourth quarter, new domestic production capacity was put into operation and ethylene glycol prices were suppressed by the supply side. At the same time, although the domestic economy is gradually recovering, the prosperity of the weaving industry is still not as good as before, and demand has not been significantly improved, resulting in twists and turns in the market price of ethylene glycol.

In 2020, the external price of ethylene glycol also showed Trends similar to market prices. The external price of ethylene glycol began to decline rapidly in January, reaching a low of US$345/ton at the end of March. Starting from April, the price fluctuated and rebounded. The overall trend was upward, and reached a relatively high level of US$545/ton on December 31.

2. Ethylene glycol cost analysis

At the beginning of 2020, affected by the public health incident, international crude oil prices experienced a process from a sharp drop to a volatile correction, and the center of gravity shifted significantly. From the perspective of crude oil supply, the historic production reduction agreement reached by OPEC+ in 2020 played a key role in the recovery of the oil market. As for the demand for crude oil, the global economic recovery is slow, and the demand for crude oil in 2020 is far lower than in previous years. Amid the uncertainty of the situation, it is still unknown what the price of crude oil will be in 2021.

In 2020, the price of ethylene in Northeast Asia is 330~ Operating between US$990/ton, the price first fell and then rose. From the perspective of downstream demand for ethylene, 63.5% is PE, 10.32% is ethylene oxide, 8.98% is ethylene glycol, 8.9% is styrene, 5.5% is PVC, and 2.8% is other needs. It can be seen that the price changes of ethylene in Northeast Asia are related to the cost-end crude oil on the one hand, and the operating conditions of downstream styrene and ethylene oxide units on the other hand. From the supply side, the 1.1 million tons/year ethylene unit of South Korea’s Lotte Chemical has restarted since it was shut down on March 4, 2020. The high ethylene price has adjusted. In the later period, as crude oil prices rebounded, ethylene prices rose again.

In 2020, amid the sharp decline in crude oil, B In the context of oversupply of glycol, the absolute price of ethylene glycol has fallen sharply, while coal prices have remained at a high level this year, which means that the cost of coal-to-ethylene glycol has changed very little. The final result is the profit of the coal-to-ethylene glycol industry. Great compression. In 2019, the coal-to-ethylene glycol industry was mainly break-even. Entering 2020, coal-to-ethylene glycol companies generally suffered losses. Affected by this, some high-cost coal-to-ethylene glycol companies were forced to suspend production, and the coal-to-ethylene glycol operating rate dropped. The average annual coal chemical industry operating rate from 2017 to 2019 was about 65-70%, but in 2020The overall construction start-up is still slightly lower than last year, but with the launch of new production capacity, polyester output has increased significantly.

At the same time, the profit differentiation of polyester is obvious. Due to the impact of the explosion in demand for masks, short fiber product profits are at a relatively high level. Due to the sharp drop in demand for textiles and clothing, the profits of filament and other products have shrunk significantly. Affected by this, the enthusiasm of factories for production has weakened. As filament yarn accounts for a relatively high proportion in the polyester industry, filament yarn factories have successively reduced production and load, resulting in a decrease in the overall start-up load of polyester.

6. Market outlook

From the supply side, in 2020, there will be approximately A 5 million-ton ethylene glycol unit is put into operation, with a production capacity growth rate of up to 47%. For 2021, from the perspective of the unit production plan, about 6.7 million tons of units are planned to be put into operation, and the actual production is expected to be about 4-5 million tons. The overall production volume remains Very big.

From the inventory point of view, starting from the beginning of 2021, affected by the rebound in import volume and the increase in maintenance of polyester during the Spring Festival, the main port of ethylene glycol in East China will reopen. library mode.

Considering from the demand side, under the expectation of inflation in 2021, coupled with the benefits of vaccines, consumption in the terminal textile and apparel industry and home textile industry may pick up.

In summary, although the ethylene glycol industry will still have excess supply in 2021, based on expectations for future increases in raw material costs and expectations for the control of public health incidents, there is still Lots of room for improvement.

</p