This week, the crude oil market oscillated downward, and the long-short game began to briefly determine the winner this week. The bulls began to retreat under the powerful fire of the shorts. , crude oil prices showed weakness at high levels.

Along with the decline in crude oil prices, there are also monthly differences. Among them, the WTI monthly difference has shown a collapse-like decline, and its decline is far lower than that of the first-line contract. The magnitude is large, which also reflects the market’s pessimistic view of U.S. crude oil supply and demand. The current demand in the U.S. market is still not improving. According to the EIA data released this week, the operating rate of U.S. refineries has declined slightly. At the same time, U.S. crude oil production seems to have entered a period of full recovery. Although demand has not yet recovered significantly, production has begun to increase. , the market is worried that the U.S. crude oil inventory reduction cycle will end prematurely.

Beyond the U.S. market, the OPEC meeting remains the focus of the market. There was news this week that Saudi Arabia and the United Arab Emirates have reached an agreement on a production reduction agreement. Saudi Arabia agreed to the UAE’s adjustment of the production base in exchange for the UAE’s support in extending the production reduction agreement until next year. The market briefly rose after hearing the news, but then Iraq also jumped out and hoped to adjust the base of production cuts. This gave Saudi Arabia a loud slap in the face. It had just appeased the UAE and jumped out of Iraq. If adjustments were also made to Iraq, then other products would be affected. Oil countries are bound to have the same idea.

In the short term, market uncertainty is still relatively large. In a chaotic environment, we still recommend that investors participate in the market with caution. Although the current market sentiment is weak, bulls may still counterattack. If there are no major negative factors on the supply side, then there will naturally be no basis for a sharp decline in the crude oil market.

From the current fundamentals, the supply-side gap is still relatively large and the market is relatively tight. It is an indisputable fact that if OPEC or other countries slowly resume crude oil production , then the future market direction can be confirmed, and bulls will have more hope of further pushing up prices. Therefore, if the market gives a reasonable price and OPEC can reach a certain agreement, customers with long-term strategic bottom-hunting needs can choose the opportunity to make arrangements.

U.S. crude oil market

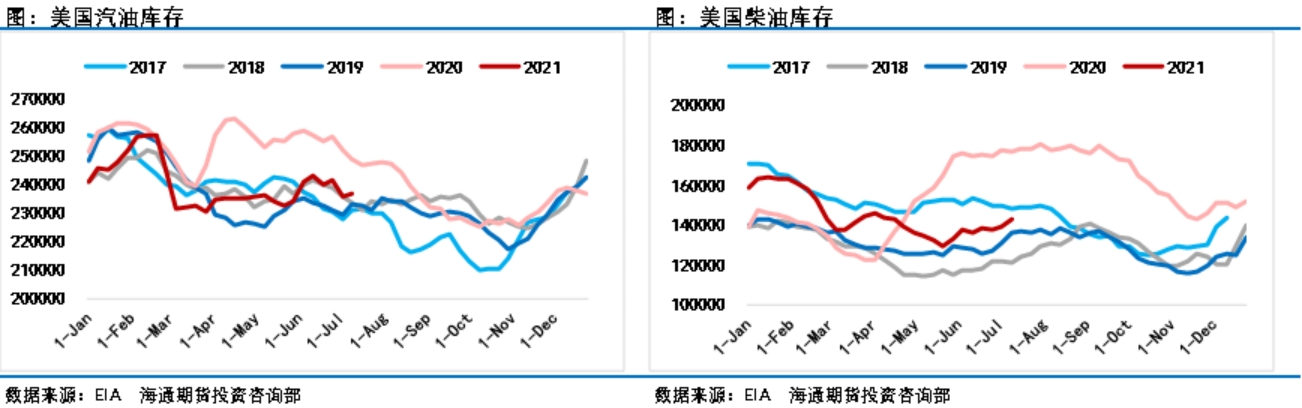

The U.S. crude oil market deserves our focus this week. After the release of EIA data, there was obvious pessimism in the crude oil market. Although U.S. crude oil inventories fell, refined oil inventories continued to accumulate, which gave the market certain pessimistic expectations. U.S. crude oil production continued to increase by 100,000 barrels/day this week, and has increased by 300,000 barrels/day for two consecutive weeks, returning to the maximum output this year. The increase in U.S. crude oil production has given the market certain pessimistic expectations. With the market facing such high oil prices, will the supply side start to exert its strength?

Judging from the current situation, the answer is yes. As oil prices rebound, the number of drilling rigs in the United States is also rising. After last year’s super oil price boom, After the collapse, the production costs of shale oil have further decreased, with most extraction costs even falling to around US$35/barrel. How can producers not be tempted by a crude oil price of US$70/barrel? Therefore, U.S. crude oil production will become the focus of market attention in the future. Although the current fundamentals still maintain tight supply, after all, U.S. shale oil can always increase production rapidly in a relatively short period of time.

In addition to crude oil production, U.S. inventories are also the focus of the market. Although crude oil inventories have declined, refined oil inventories continue to accumulate significantly, which makes last week’s decline The market’s expectations for the recovery of the demand side have naturally been hit. Moreover, even if crude oil inventories decline, it is not a rebound in demand. Data show that the operating rate of U.S. refineries not only did not increase last week, but fell by 0.4%. The main reason for the decline in inventories was the massive increase in exports. U.S. crude oil exports increased by more than 1 million barrels last week, returning to a new high for the same period.

The key to the market now is whether U.S. crude oil production will increase significantly and whether U.S. crude oil demand can recover as quickly as market forecasts. The military morale in the current market is already unstable, and bulls are facing heavy pressure. If even the U.S. supply side comes to suppress it, then bulls will only have the advantageous weapon of the demand side.

The market is waiting for the implementation of the OPEC agreement

In fact, the reason why OPEC has not significantly increased production for a long time has something to do with shale oil. If shale oil prices As production continues to increase when it rebounds, OPEC must also consider whether market share will be seized by shale oil when formulating production reduction policies. Now there are many contradictions within OPEC, and the timely increase in shale oil production has the purpose of further dividing OPEC.

Now the market focus is on what kind of production increase agreement will be reached at the OPEC meeting. It is now mid-July, and August is only half a month away. Within half a month, OPEC still cannot come up with an effective plan, so it is possible that there will be no increase in production in August, the supply-side gap will increase, and the market will have further upward momentum.

Within this half month, OPEC reached an agreement to increase production by less than 1 million barrels, which is acceptable to the market. As long as the increase in production is not large, or the UAE increases the base of production reduction and implements it in batches, it will be acceptable to the market. This is good news for bulls. After all, the current supply gap in the market is greater than OPEC’s production increase.

Judging from the current situation, although there are differences between OPEC Contradictions, but they are not irresolvable. We do not believe that conflicts within OPEC will amplify and intensify indefinitely, nor do we think that this incident will lead to the collapse of OPEC’s overall production reduction agreement. Therefore, as long as OPEC can give the market a relatively satisfactory The answer is that bulls will have nothing to fear, and oil prices will have room to continue to rise.

This week, the United States began to partially lift the embargo on Venezuela and Iran. Explain to the market that if oil prices are too high to be controlled, it is entirely possible for Biden to follow Trump’s lead and put Venezuela’s crude oil production and Iran’s crude oil production on the market. If this is the case, it is not ruled out that the market will repeat what happened in 2018 The sharp decline after October.

Currently, Iran’s crude oil production is a key bargaining chip for the United States to negotiate the Iran nuclear agreement. It is impossible for the Biden administration to do this Easy to use. Therefore, regarding the news about Iran, we need to wait until there is further clear news about the Iran nuclear agreement before we can judge the impact on oil prices. Now, Iran’s new president has not yet taken office, and the Iran nuclear deal will not really begin until August when the new Iranian president takes office. However, Iran’s new President Raisi is also a hardliner, and whether the Iranian nuclear agreement can be reached in a short time is also a variable. So for Iran and Venezuela, we may see fluctuations in market sentiment in the short term, but it seems unlikely that we will see the output of these two countries released into the market in the short term.

Taken together, various variables on the supply side are not conducive to changes in oil prices, whether it is the increase in U.S. shale oil production, OPEC’s increase in production, or Iran and Venezuela The possible release of crude oil production is an important means to suppress the enthusiasm of bulls. However, as we analyzed above, these factors are only in the early stages of the conflict, and no substantial results have yet been seen. At least in the short term, the negative effects on the supply side will not be reflected in the spot market, nor will it fundamentally suppress oil prices.

The epidemic still brings disturbance

On the demand side, the epidemic is still not over, and many countries are still implementing blockade policies. At present, the UK seems to have calmed down and no longer implements blockade measures, so we have recently seen a crazy increase in the number of new confirmed cases in a single day in the UK. In addition to the UK, the number of new confirmed cases in Asia, America and Africa is also showing signs of rising. The global epidemic has shown some bad signs under the influence of the Delta virus. Asian countries like Indonesia and Japan continue to implement lockdowns, and the Tokyo Olympics also decided not to have spectators. Therefore, the global anti-epidemic situation is still relatively severe. Although vaccines are becoming more and more popular, the speed of vaccine popularization is far from keeping up with the speed of virus spread. This is also a potential negative factor for the future demand for crude oil.

In a chaotic environment, we still recommend investors to participate in the market with caution. Although the current market sentiment is weak, it does not mean that bulls have no possibility of counterattack. If there are no major negative factors on the supply side, then there will naturally be no basis for a sharp decline in the crude oil market. Judging from the current fundamentals, the gap on the supply side is still relatively large, and it is an indisputable fact that the market is relatively tight. If OPEC or other countries slowly resume crude oil production, then bulls can confirm the future market direction, and there will be more hope for further promotion. Increase prices. Therefore, if the market gives a reasonable price, customers with long-term strategic bargaining needs can choose the opportunity to make arrangements.

As countries slowly resume crude oil production, bulls can confirm the future market direction and have more hope of further pushing up prices. Therefore, if the market gives a reasonable price, customers with long-term strategic bargaining needs can choose the opportunity to make arrangements.

</p